Current Status and Trends of Tesla Share Price

Introduction

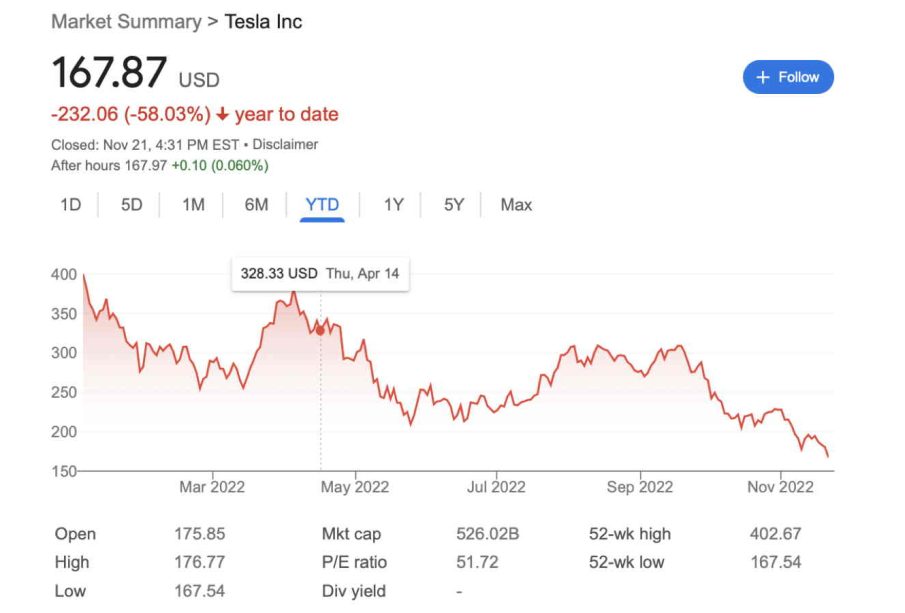

The share price of Tesla, Inc., a leading electric vehicle and renewable energy company, is a critical indicator not just of the company’s financial health but also of broader market trends in technology and sustainability. Given the growing interest in electric vehicles worldwide and potential transitions toward greener technologies, the fluctuations in Tesla’s share price carry implications for investors, analysts, and consumers alike. As of now, Tesla’s share price remains a topic of much discussion and analysis.

Recent Trends and Fluctuations

As of October 2023, Tesla’s share price has experienced significant volatility, reflecting both market conditions and the company’s operational performance. Recently, the stock saw a notable uptick, reaching approximately £200 per share, driven primarily by optimistic sales forecasts and the successful launch of new models in emerging markets. However, earlier in the year, prices had dipped below £150 due to supply chain challenges and increasing competition from other automotive manufacturers entering the electric vehicle sector.

Factors Influencing Tesla’s Share Price

Several factors are influencing the current share price of Tesla. Firstly, the company’s quarterly earnings reports have shown increased revenues, supported by higher vehicle deliveries and improved profit margins. Additionally, developments in battery technology and production capacity have reassured investors regarding the company’s long-term growth.

On the other hand, macroeconomic factors such as inflation rates, interest rate hikes, and global economic uncertainties also play a role in share price dynamics. The recent announcement from the Federal Reserve about potential interest rate adjustments created a ripple effect across tech stocks, including Tesla’s. Moreover, shifts in consumer preferences and government policies towards electric vehicles in various countries can impact investor sentiment significantly.

Market Forecast

Looking ahead, analysts are cautiously optimistic about Tesla’s share price trajectory. Projections suggest that if Tesla continues to perform well in terms of deliveries and expands its market share in Asia and Europe, its stock could appreciate further. However, experts have warned of possible corrections, should economic conditions change adversely or if competition intensifies beyond current expectations.

Conclusion

In conclusion, Tesla’s share price remains a vital barometer of both individual company performance and the larger trends influencing the electric vehicle market. Investors should stay informed about market conditions and the latest company developments to navigate potential risks while considering opportunities for investment. As trends evolve, Tesla’s ability to adapt will undoubtedly play a crucial role in determining its future share price stability and growth.