Current Developments in Government State Pension Age

Introduction

The government state pension age is a vital issue for millions of individuals nearing retirement across the United Kingdom. As life expectancy increases and economic pressures mount, the state pension age has been adjusted multiple times in recent years. Understanding these changes is crucial for planning future finances and ensuring a secure retirement.

Recent Changes to State Pension Age

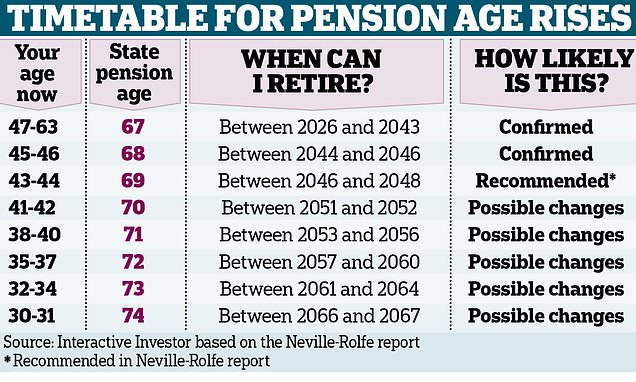

As of September 2023, the state pension age in the UK is set to rise to 67 for both men and women by 2028. This adjustment is based on the provisions outlined in the 2014 Pensions Act, which sought to reflect the increasing lifespan of the population. Originally set to gradually increase from 65 to 66 and now to 67, further increases have been proposed through the recent government reviews. Reports suggest that by 2037, the state pension age could rise to 68, targeting a phased implementation beginning in 2037, affecting individuals born between 1970 and 1978.

Impact on Individuals

These changes pose significant implications for workers, particularly those in physically demanding jobs or lower income brackets, who may find it challenging to continue working into their late sixties. Many individuals may need to reconsider when they can afford to retire, especially with the cost of living increasing and job market instability. Additionally, those who have planned their finances around the age of eligibility for the state pension may find themselves unprepared for a longer working life.

Government Response

The government states that increasing the state pension age is necessary to maintain the sustainability of the pension system amid changing demographics. However, this has sparked debate on whether the measures are fair, especially for those with shorter life expectancies associated with certain socioeconomic factors. The government has been urged to provide clearer communication regarding the timeline of changes and their implications, alongside potential support for affected groups.

Future Considerations

As the government reviews its pension policies further, residents should keep abreast of developments concerning the state pension age. Financial planning is essential as individuals prepare for their retirement years. Those affected by the rising pension age may need to seek financial advice to ensure their retirement funds are adequately prepared.

Conclusion

The evolution of the government state pension age is a significant development for the UK population. With the potential for future increases, it remains imperative that individuals engage with this topic to ensure they are aware of their rights and obligations. As discussions continue in parliament and public forums, the decisions made now will shape not only the next decade of retirees but also the future financial landscape of the nation.