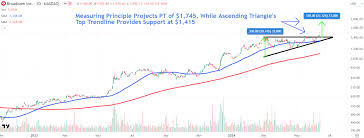

Broadcom Share Price Hits New Heights as AI Chip Business Booms and VMware Integration Shows Success

Strong Performance and Market Position

Broadcom’s shares have demonstrated remarkable growth, rising 32% year-to-date and nearly doubling over the past 12 months. The company’s market capitalization has now surpassed $1.4 trillion as it positions itself at the center of the artificial intelligence boom.

Recent Financial Results

The company’s fiscal third-quarter earnings exceeded Wall Street expectations, with the stock rising in extended trading after announcing a $10 billion order from a new client for custom chips. The company reported earnings per share of $1.69 adjusted versus $1.65 expected, and revenue of $15.96 billion versus $15.83 billion expected. Furthermore, Broadcom projects fourth-quarter revenue of $17.4 billion, surpassing analyst estimates of $17.02 billion.

AI Growth and Innovation

The company’s impressive third-quarter revenue growth was attributed to custom AI accelerators, networking components, and VMware software integration. AI revenue showed a remarkable 63% increase to $5.2 billion, exceeding previous predictions of $5.1 billion. The company expects AI revenue to reach $6.2 billion in the next quarter.

VMware Integration Success

The integration of VMware has proven successful, with revenue in the infrastructure software business rising 43% to $6.79 billion. This success follows Broadcom’s significant $61 billion acquisition of VMware, which has enhanced the company’s server virtualization software capabilities.

Future Outlook

Investors are showing optimism about Broadcom’s potential to challenge Nvidia’s dominant position in the AI chip market. The company’s CEO, Hock Tan, has confirmed development of new AI chips with three major cloud customers, indicating continued AI growth through next year. The market confidence is reflected in analyst recommendations, with 39 out of 42 analysts covering Broadcom recommending buying shares, including six with a Strong Buy rating.