Boeing Stock: Current Performance and Future Outlook

Introduction

Boeing stock has been an essential topic for investors and analysts alike, especially in light of recent developments affecting the aerospace industry. As one of the largest aircraft manufacturers globally, Boeing’s financial health and stock performance hold significant implications for the aviation sector and wider economy. Recent market fluctuations have heightened interest in the company, prompting investors to analyse its prospects thoroughly.

Recent Performance

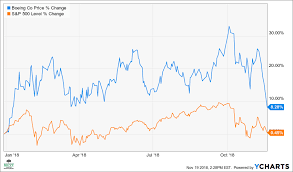

As of October 2023, Boeing stock has experienced substantial volatility driven by various factors, including supply chain disruptions, regulatory challenges, and recovery from the impacts of the COVID-19 pandemic. After witnessing a dip in 2022, the stock has shown signs of resilience, with a notable increase of approximately 20% since the beginning of this year, soaring to around £220 per share. Analysts credit this rebound to an uptick in both commercial and defence aerospace orders, with the company reporting a backlog of over 4,000 jetliners.

Market Factors

Several factors are influencing Boeing’s stock performance. First, the aircraft manufacturer has recently announced a strategic partnership with a number of airlines to address the ongoing supply chain issues effectively. This collaboration aims to enhance production capacity and expedite the delivery timelines for new aircraft. Furthermore, the anticipated recovery in international travel is expected to boost demand for new airliners, which could positively affect Boeing’s revenue in the coming quarters.

Moreover, the ongoing geopolitical tensions and military demand also play a significant role, as Boeing’s Defence, Space & Security division is expected to see increased funding. This shift can provide a buffer against fluctuations in commercial aircraft sales.The recent unveiling of new, fuel-efficient models has also garnered positive attention from investors and may play a pivotal role in shaping future stock trends.

Future Outlook

Looking forward, analysts remain cautiously optimistic about Boeing stock. Analysts predict that if the company can continue to navigate supply chain complexities and maintain its production timelines, we may see further growth in stock value. As air travel demand continues to recover post-pandemic, Boeing’s ability to deliver on its production goals will be paramount.

In conclusion, Boeing stock represents an intriguing investment opportunity marked by both potential and risk. For investors, closely monitoring key developments, including production rates, market demand, and geopolitical factors will be essential in making informed decisions. Ultimately, while Boeing has demonstrated resilience, the evolving landscape of the aerospace industry will determine its stock trajectory in the years ahead.