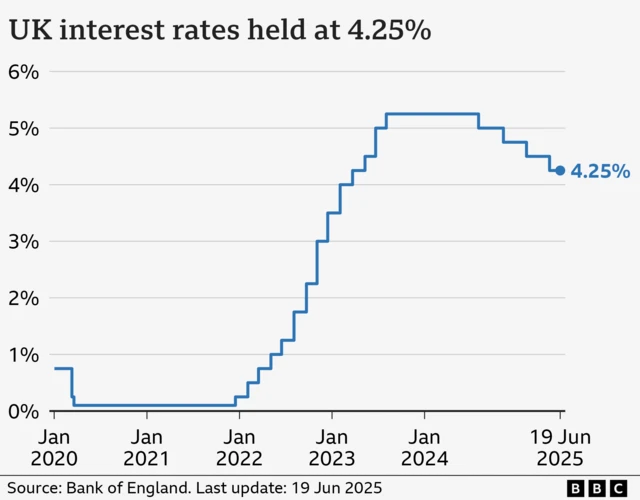

Bank of England Base Rate: What Recent Decisions Mean for Households and Business

Introduction: Why the Bank of England base rate matters

The Bank of England base rate is a central tool of UK monetary policy and a key influence on borrowing costs, savings returns and wider economic activity. Changes to the base rate, decided by the Bank’s Monetary Policy Committee (MPC), aim to meet the Bank’s inflation target and sustain stable growth. For households, businesses and financial markets, announcements about the base rate are closely watched for their immediate and longer-term effects.

Main body: Context, impact and immediate reactions

Decision and economic context

The Monetary Policy Committee sets the base rate to achieve the Bank’s inflation target. Recent meetings have taken place against a backdrop of shifting inflationary pressures, wage growth and changes in global commodity prices. The MPC considers a range of indicators — including consumer price inflation, labour market data and GDP growth — when weighing whether to raise, hold or lower the base rate.

Impacts on households and businesses

Movements in the base rate quickly filter through to mortgage rates, consumer credit and business borrowing. A rise in the base rate typically increases the cost of variable-rate mortgages and some loans, while a cut tends to lower borrowing costs. For savers, higher base rates can translate into improved returns on certain deposit accounts, although individual outcomes depend on bank and building society pricing decisions.

Financial markets and the pound

Markets react to both the decision itself and the Bank’s commentary on future policy. Expectations about the path of the base rate influence gilt yields, bank funding costs and the exchange rate of sterling. Clear guidance from the Bank can help reduce market volatility, while uncertainty can increase it.

Conclusion: What to watch and likely significance

Looking ahead, the significance of any change in the Bank of England base rate will depend on how inflation, employment and growth evolve. Households with variable-rate borrowing should consider how rate shifts affect monthly payments, while businesses should factor borrowing costs into investment plans. For readers, the practical takeaway is to monitor official MPC statements and reputable financial advice to understand how base rate moves may affect personal finances and business decisions.