argenx Demonstrates Strong Growth in Q2 2025 with VYVGART Success and Pipeline Expansion

Record-Breaking Quarter Showcases Commercial Success

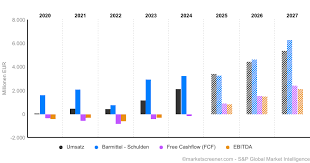

argenx has reported exceptional Q2 2025 financial results, with global product net sales reaching $949 million, representing 97% year-over-year growth. The company achieved $245 million in quarterly profit, with earnings per share of $4.02.

Expanding Patient Reach and Treatment Options

CEO Tim Van Hauwermeiren highlighted the company’s meaningful progress towards Vision 2030, noting that VYVGART is delivering strong growth across all indications, formulations and regions, having already reached more than 15,000 patients globally.

In a significant development, argenx received European Commission approval for VYVGART SC as a monotherapy for treating adult CIDP patients after prior corticosteroid or immunoglobulin treatment, marking the first novel treatment mechanism for CIDP in over 30 years. The approval was supported by the ADHERE trial, where 66.5% of patients showed clinical improvement and demonstrated a 61% reduction in relapse risk versus placebo.

Pipeline Progress and Future Outlook

The company recently announced positive topline results from its ADAPT SERON phase 3 study of VYVGART in AChR-Ab seronegative generalized myasthenia gravis (gMG) patients. This breakthrough represents the first global phase 3 study showing clinical benefits across all three seronegative subtypes: MuSK+, LRP4+, and triple seronegative. The company plans to submit a Supplemental Biologics License Application (sBLA) to the FDA by the end of 2025 to expand VYVGART’s label.

Looking ahead, argenx has established its ‘Vision 2030’ to outline the next phase of growth as part of its long-term commitment to transform the treatment of autoimmune diseases. Through this vision, the company aims to treat 50,000 patients globally with its medicines, secure 10 labeled indications across all approved medicines, and advance five pipeline candidates into Phase 3 development by 2030.

Financial Outlook

argenx maintains its guidance for combined R&D and SG&A expenses at approximately $2.5 billion for 2025. This cash generation supports their ambitious clinical development plans while maintaining financial sustainability.