Analyzing the FTSE 100 Index: Current Trends and Future Projections

Introduction

The FTSE 100 Index, often referred to as the ‘Footsie’, serves as a barometer of the UK stock market’s health and economic performance. Comprising the 100 largest companies listed on the London Stock Exchange, its fluctuations can influence investment decisions and reflect broader economic sentiment. Understanding the FTSE 100 is crucial for both investors and those interested in the UK’s financial landscape.

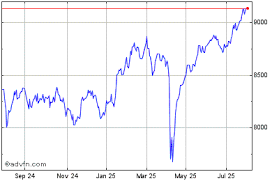

Current Status of the FTSE 100

As of October 2023, the FTSE 100 Index has experienced a volatile trading period, reflecting various economic factors, including inflation rates, interest rate adjustments by the Bank of England, and geopolitical tensions. Over the past few months, significant players like BP, AstraZeneca, and Unilever have showcased mixed earnings reports that impacted the Index significantly. Recently, the FTSE 100 has hovered around the 7,400 mark, rebounding slightly after a dip attributed to inflationary pressures that have plagued markets globally.

Economic Factors Influencing Performance

Several critical factors have been driving the performance of the FTSE 100 in 2023:

- Inflation Rates: Continuing high inflation has pressured consumer spending, impacting major retail and consumer goods companies.

- Interest Rates: The Bank of England’s decisions regarding interest rates have created ripple effects in investment strategies, with higher interest impacting borrowing and spending habits.

- Geopolitical Events: Ongoing global tensions and energy crises, particularly stemming from the Ukraine conflict, have continued to impact market stability.

Future Forecasts

Looking ahead, analysts suggest that the FTSE 100 may see fluctuations based on both domestic and international developments. If inflation rates begin to stabilise and the global economy shows signs of recovery, there could be potential for growth within the Index. However, persistent geopolitical tensions and economic uncertainty mean that investors should proceed with caution. Additionally, shifts towards green energy and technology could redefine capital allocation, potentially benefitting certain sectors more than others.

Conclusion

In summary, the FTSE 100 Index remains a crucial measure of the UK market’s performance, reflecting the broader economic environment. For investors, understanding the underlying factors influencing this Index is essential for informed decision-making. As we approach the end of 2023, the focus will likely remain on inflation trends, interest rate adjustments, and their combined effects on market sentiment.