Analyzing the Current Trends in IAG Share Price

Introduction

The IAG share price has become a focal point for investors and analysts alike as the insurance sector continues to navigate the impacts of global economic conditions. Insurance Australia Group (IAG), one of the largest general insurers in Australia and New Zealand, plays a significant role in the Australian financial landscape. Understanding its share price movements can provide insights into broader market trends and investor sentiment.

Current Trends Around IAG Share Price

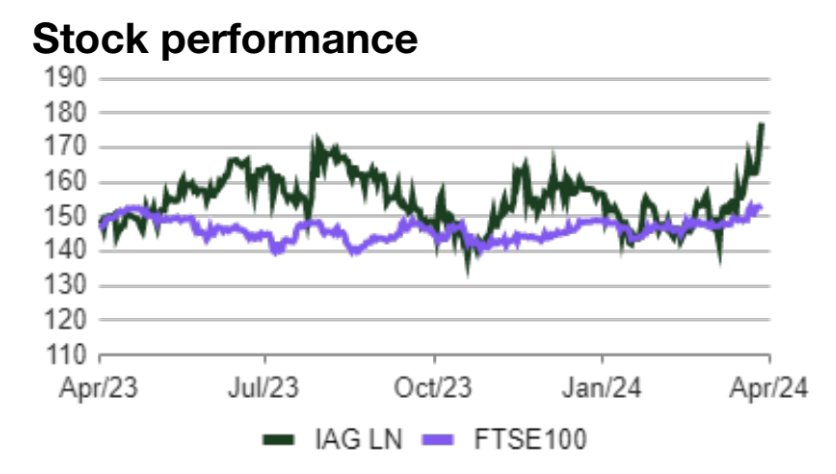

As of October 2023, the IAG share price has experienced considerable fluctuations, impacted by multiple factors including economic performance, regulatory changes, and the effects of natural disasters. Recently, IAG shares were trading at around AUD 5.80, showing a decrease of approximately 3% over the past month. This decline can be attributed to rising inflation and increased claim costs which have affected profitability forecasts for the upcoming quarters.

Analysts predict that changes in interest rates and the Australian economy’s overall performance will significantly influence IAG’s share price in the near term. Furthermore, ongoing discussions about climate-related insurance risks and their implications for underwriting practices are causing concern among investors, influencing their perceptions of IAG’s stability.

Factors Influencing Share Price

One of the key contributors to IAG’s share price volatility is its exposure to natural disasters. The company reported substantial claims from recent severe weather events, which have raised questions about the adequacy of its premium pricing and capital reserves. In response to these challenges, IAG has been actively adjusting its risk management frameworks and pricing strategies to mitigate further impacts.

Additionally, investor relations and management comments in quarterly earnings reports also have a strong effect on share price performance. The upcoming Q3 earnings announcement later this month is anticipated to provide critical insights into how well IAG is managing its claims, and this may trigger changes in investor sentiment and share price movements.

Conclusion

The IAG share price remains a barometer for investor confidence in the insurance sector amid an evolving economic environment. With upcoming earnings reports and ongoing global economic challenges, stakeholders should keep a close watch on IAG’s performance metrics and market responsiveness. Investors are advised to consider these factors before making decisions, as the share price could fluctuate based on both internal factors within the company and external economic influences.