An Overview of the Nikkei 225 Index and Its Current Trends

Introduction to the Nikkei 225

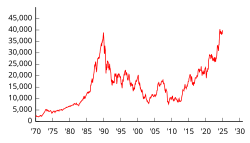

The Nikkei 225, a benchmark stock market index for the Tokyo Stock Exchange (TSE), is one of the most vital indicators of Japan’s economic health. It reflects the performance of 225 large, publicly-owned companies in Japan, including global giants such as Toyota, Sony, and Honda. As Japan’s premier index, its fluctuations are closely watched by investors around the world, making it a barometer of both the local and global economy.

Recent Trends and Current Events

As of October 2023, the Nikkei 225 has experienced significant fluctuations. Following a period of recovery from the pandemic, the index saw a rise, peaking at around 32,000 points in early September. However, concerns about inflation and central bank policy have led to volatility in recent weeks. For instance, the Bank of Japan’s decision to maintain its ultra-loose monetary policy, despite global tightening trends, has sparked mixed reactions. This ongoing strategy aims to stimulate the economy but may also lead to a depreciation of the yen, impacting investor confidence.

Market analysts have noted that sectors such as technology and export-oriented companies have driven the index’s gains this year. In recent weeks, global supply chain issues and energy prices have influenced market sentiment, resulting in cautious trading activity. Moreover, the Nikkei 225 is also affected by international market trends, particularly movements in the US markets. The correlation between the two has become more pronounced in recent months, highlighting the interconnectedness of global finance.

Significance for Investors

The Nikkei 225 offers a unique opportunity for both local and foreign investors. For those looking to invest in Japan’s growing companies, this index serves as an entry point to understanding market dynamics. Its performance can provide insights into consumer sentiment and economic stability, influencing investment decisions. Many investment funds and portfolios track this index, reflecting its importance in global markets.

Conclusion

The Nikkei 225 remains a crucial gauge for Japan’s economic landscape and investor sentiment. As the index continues to react to both domestic and international factors, it presents various opportunities and risks for investors. With ongoing economic challenges, including inflation pressures and geopolitical unrest, the index’s direction will be essential to monitor for those interested in the Japanese market. In the coming months, analysts predict that investors will remain cautiously optimistic, adjusting their strategies based on economic indicators and policy changes.