An Overview of Google Share Price Trends and Analysis

The Importance of Google Share Price

The share price of Google, officially known as Alphabet Inc., is a critical indicator of the company’s market health and investor sentiment. As one of the world’s leading technology giants, fluctuations in its stock can significantly impact the broader market trends, particularly in the tech sector.

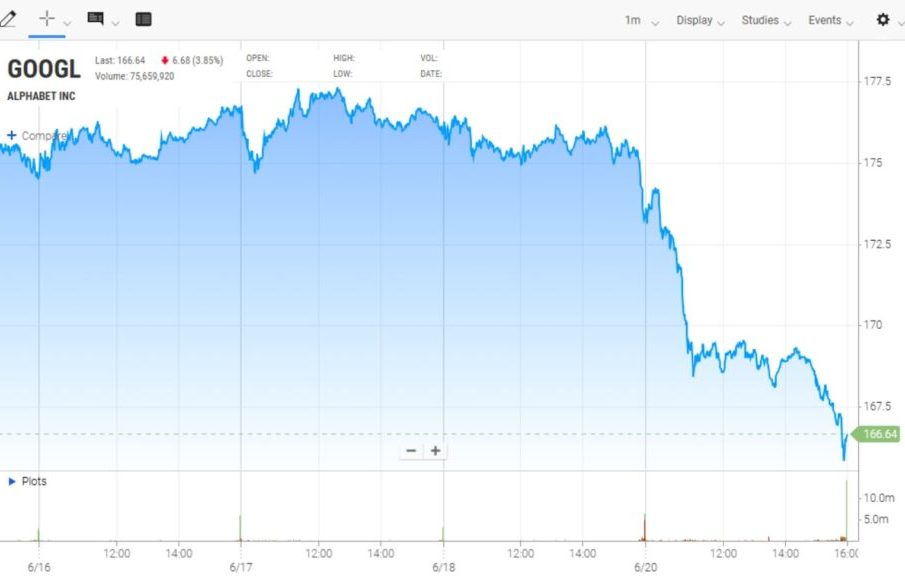

Recent Trends in Google Share Price

As of October 2023, Google share price has experienced notable volatility. Earlier this month, shares peaked at a new high of $150 following a strong quarterly earnings report, which highlighted a significant increase in advertising revenue and growth in cloud services. However, concerns over regulatory challenges and heightened competition in the technology space have contributed to a slight decline, bringing the current share price to approximately $145.

Market analysts attribute this fluctuation largely to the ongoing regulatory scrutiny facing big tech companies and the potential impact of rising interest rates. Furthermore, the company’s heavy investment in artificial intelligence and other emerging technologies is seen as a double-edged sword; while they hold potential for high returns, they also come with considerable risk.

Market Sentiment and Future Projections

Investor sentiment around Google has been mixed. Some analysts remain optimistic, projecting that the share price could rebound as the company continues to innovate and expand its market reach. However, others caution that regulatory pressures could hinder long-term growth prospects. A recent survey suggested that while 65% of investors retain a ‘buy’ position on Google, 20% are considering liquidation based on those regulatory fears.

A key factor influencing future share price will be the upcoming earnings call scheduled for late November 2023. Investors will be looking closely at revenue forecasts and any updates on legal challenges that could sway market perceptions. Additionally, the overall performance of the tech sector in the approaching months will likely have spillover effects on Google’s share price.

Conclusion

In conclusion, as Google navigates through a landscape marked by high expectations and substantial challenges, its share price will continue to be a focal point for investors, analysts, and market watchers alike. Understanding the dynamics influencing Google share price is essential for making informed decisions in the stock market. As technologies and market conditions evolve, so too will the trajectory of Google’s stock, making it a vital topic for ongoing discussion.