An Overview of Car Tax in the UK: What You Need to Know

The Importance of Car Tax

Car tax, also known as vehicle excise duty (VED), is an essential aspect of vehicle ownership in the United Kingdom. This tax is crucial because it contributes significantly to the funding of public services and infrastructure, including road maintenance and environmental projects. The amount you pay depends on a variety of factors including vehicle emissions, age, and value. Understanding car tax is vital for all motorists as it can affect overall ownership costs.

Latest Developments in Car Tax

In recent months, the UK government has announced a series of changes affecting car tax that are set to take effect in the coming fiscal year. As of April 2023, new regulations will be implemented whereby electric vehicles will be required to pay a nominal rate of VED after their first year of exemption, aimed at raising funds to maintain roads while encouraging a shift towards more environmentally friendly vehicles.

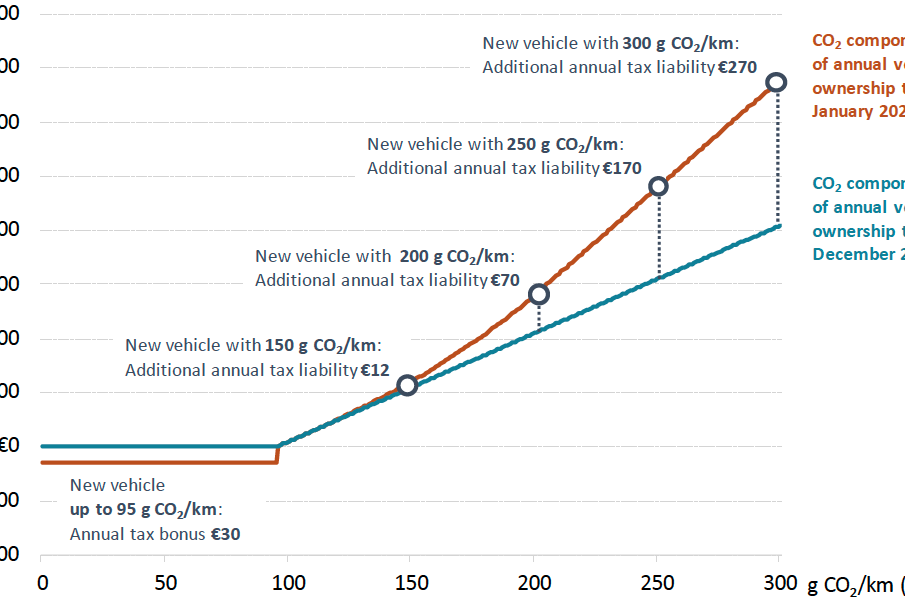

In addition, the introduction of new emission bands means that many petrol and diesel vehicles could see an increase in their annual tax rate. The most affected will be higher emission vehicles which will face significantly higher fees. The government is shifting its policy focus towards reducing carbon emissions, thus aligning tax structures to encourage cleaner transport choices.

How Car Tax is Calculated

The calculation of car tax is based on the official CO2 emissions of the vehicle when it is first registered. Vehicles that produce zero emissions, such as electric vehicles, benefit from lower tax rates. However, as many consumers are leaning towards greener alternatives, the tax model is evolving, making it essential for potential buyers to factor in future tax implications when choosing a vehicle.

Conclusion: The Future of Car Tax

As the UK moves closer to achieving its ambitious climate targets, changes in car tax will continue to evolve. Motorists will need to stay informed about these regulations to avoid unexpected costs. Moreover, as electric vehicle adoption increases, the government may need to adjust taxation methods to ensure sustained revenue from the VED system. For car owners and prospective buyers alike, understanding the intricacies of car tax will remain crucial in making informed decisions regarding their vehicles.