An In-Depth Look at the Recent Stock Market Crash

Introduction to the Stock Market Crash

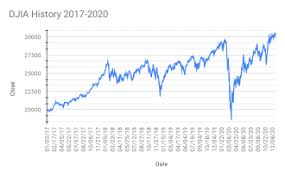

The recent stock market crash has sent shockwaves through global economies, impacting investors and businesses alike. Understanding the significance of this event is crucial for any stakeholder in the financial landscape. The crash, which began in late October 2023, has been attributed to a combination of factors, including rising inflation rates, increased interest from central banks, and geopolitical tensions, making it a pivotal moment for both seasoned investors and novices.

Key Factors Leading to the Crash

The stock market crash of October 2023 was triggered by several key events. Firstly, inflation rates surged to a 40-year high, prompting fears of an aggressive response from central banks. The Bank of England, along with other major central banks, announced a series of interest rate hikes aimed at combating rising prices, which resulted in increased borrowing costs for consumers and businesses.

Simultaneously, geopolitical tensions intensified with ongoing conflicts in Eastern Europe, leading to supply chain disruptions and increased energy prices. The combination of these factors created an environment of uncertainty, causing investor confidence to plummet. Major indices, including the FTSE 100 and the S&P 500, saw substantial declines, wiping billions off market capitalisation.

Consequences of the Crash

The repercussions of the stock market crash have been widespread. Retail investors, many of whom are new to the market, faced significant losses, leading to a surge in panic selling. Analysts have noted that this crash underscores the fragility of the market in the face of external pressures. Additionally, companies reliant on stock prices for funding have begun to reconsider their growth strategies, which could lead to a slowdown in economic expansion.

Looking Ahead: What Lies Beyond?

As the dust settles from the crash, analysts are cautiously optimistic about a potential recovery. Historically, stock market crashes are often followed by periods of consolidation and eventual resurgence. Experts advise that investors should take a long-term view, focusing on fundamentals rather than short-term fluctuations.

In conclusion, the stock market crash of October 2023 serves as a stark reminder of the volatility inherent in financial markets. Stakeholders must remain informed and adaptable in these challenging times, as recovery opportunities may arise amidst the uncertainty. As always, prudent investment strategies and risk management will be key to navigating the post-crash landscape.