Alphabet share price: recent highs and market snapshot

Introduction

The alphabet share price remains a closely watched indicator for global investors and technology market observers. Movements in Alphabet’s stock influence broader market sentiment given the company’s significant size and role in digital advertising, cloud services and consumer products. Recent live quotes and historical data provide a snapshot of where the shares stand and why the price action matters to shareholders and analysts.

Main developments

Live quotes and recent highs

Live trading data show differing quotes for Alphabet’s share classes. The GOOG ticker was reported at $321.46, noted as the highest level since December 2025. Separately, MarketWatch quotes Alphabet Inc. Class A (GOOGL) at $331.71. These differences reflect the separate listings for Alphabet’s Class C (GOOG) and Class A (GOOGL) shares and the usual small spreads between them.

Short- and medium-term performance

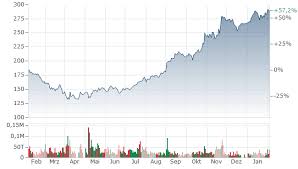

Over the past four weeks Alphabet recorded a gain of 1.91%. The available information also indicates the stock has increased over the last 12 months, underscoring a period of appreciation for the company’s equity, though a precise 12‑month percentage was not provided in the sourced details.

Key metrics from price history

Macrotrends’ 22-year price-history listing includes a market capitalisation figure for Alphabet of $4161.908B and an accompanying metric of 34.01 as shown on that platform. These long‑term data resources are commonly used to contextualise current price moves against historical trends and broader valuation measures.

Conclusion

For readers tracking the alphabet share price, the immediate takeaway is that Alphabet is trading near recent highs on at least one quoted series, with modest gains over the past month and positive movement year‑on‑year. Investors are likely to monitor both Class A and Class C quotes (GOOGL and GOOG) alongside valuation metrics and broader market conditions. Given the mixed live quotes and the importance of up‑to‑date data feeds, observers should consult current market sources when making time‑sensitive decisions and consider the different tickers when comparing prices and performance.