All You Need to Know About Credit Scores

Introduction: The Importance of Credit Scores

In today’s financial landscape, understanding your credit score is crucial for securing loans, mortgages, and even rental agreements. A credit score is a numerical representation of your creditworthiness and is widely used by lenders to evaluate potential risks associated with lending money. With many individuals unaware of the factors that influence their scores, it is essential to explore the significance of credit scores and their impact on financial decisions.

Understanding Credit Scores

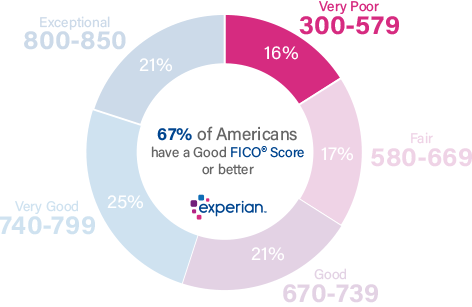

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. The three primary credit bureaus, Experian, Equifax, and TransUnion, calculate these scores based on five key factors: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and types of credit used (10%). Maintaining a good credit score is vital, as it can directly affect the interest rates and terms you receive on loans and credit cards.

Current Trends in Credit Scoring

As of October 2023, the economic landscape is experiencing shifts that affect credit scores. With rising interest rates and inflation, many consumers are relying on credit more than ever, which can impact their scores negatively if not managed properly. The recent increase in interest rates has made it essential for individuals to pay close attention to their credit reports and make timely payments. Moreover, public awareness campaigns are emphasising the need for credit education, encouraging individuals to check their scores regularly and understand how to improve them.

How to Improve Your Credit Score

If you find your credit score to be lower than desired, there are several steps you can take to improve it. Begin by checking your credit report for errors and dispute any inaccuracies. Additionally, consistently making payments on time, reducing high credit card balances, and avoiding new credit inquiries can lead to significant improvements over time. Furthermore, speaking with financial advisors can help in formulating a tailored plan to enhance your credit score.

Conclusion: The Future of Credit Scores

As financial institutions continue to adopt advanced analytics and machine learning in assessing creditworthiness, it is likely that credit scoring methods will evolve. However, the fundamental role of credit scores in facilitating access to financial resources will remain unchanged. For readers, understanding and monitoring their credit score should be a priority, serving as a critical tool in achieving financial stability and success.