A Comprehensive Overview of Inheritance Tax in the UK

Introduction

Inheritance tax is a significant financial consideration for many families in the UK, impacting how wealth is passed down through generations. With increasing property prices and estate values, understanding inheritance tax is crucial for effective financial planning and ensuring that loved ones receive their intended inheritance without unexpected burdens.

What is Inheritance Tax?

Inheritance tax (IHT) is a tax on the estate of a deceased person, which includes all property, possessions, and money. In the UK, IHT is typically charged at 40% on the value of the estate that exceeds the nil-rate band, which is currently £325,000 for individuals. The nil-rate band is the threshold below which estates do not incur any IHT.

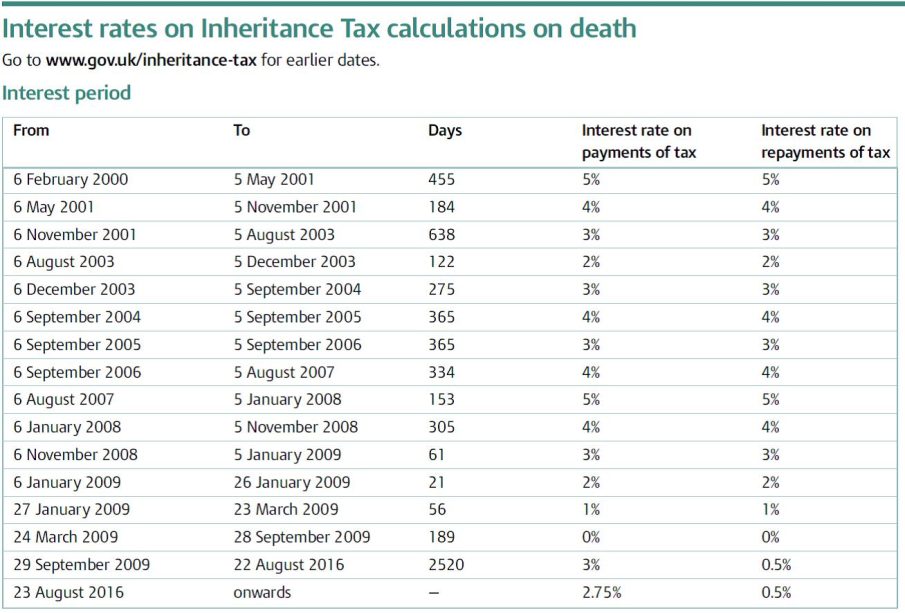

Recent Changes and Current Regulations

Recent reports indicate a gradual increase in the number of estates liable to pay inheritance tax due to the rise in property values, particularly in high-demand areas. In the 2021-2022 tax year, HM Revenue and Customs (HMRC) collected approximately £5.4 billion in inheritance tax, reflecting a 10% increase from the previous year. To mitigate tax liabilities, individuals are employing various strategies, such as gifting assets during their lifetime and utilising reliefs available for business properties and agricultural land.

Exemptions and Reliefs

There are several exemptions and reliefs available that can significantly reduce the inheritance tax burden. For example, any gifts made to spouses or civil partners are exempt from IHT. Additionally, annual gifts up to £3,000 are also exempt, as are gifts made three years before death, provided they are under certain limits. The residence nil-rate band, introduced in 2017, allows for an additional threshold if the ‘main residence’ is passed to direct descendants, enhancing the potential for tax relief.

Conclusion

Understanding and navigating the complexities of inheritance tax is essential for individuals looking to pass on wealth effectively. With ongoing changes in property valuations and tax regulations, it is advisable to seek professional financial advice to optimise estate planning strategies. As the UK’s population ages, conversations around IHT will likely become more prevalent, making it crucial for individuals to stay informed about their options and obligations.