A Comprehensive Guide to Stocks and Shares ISA

Introduction

The Stocks and Shares Individual Savings Account (ISA) is an investment tool that allows individuals in the UK to save and invest their money in a tax-efficient manner. With the ongoing economic fluctuations and rising cost of living, understanding how to effectively manage savings and investments has become increasingly important for many. Stocks and Shares ISAs present an opportunity for investors to grow their wealth free from tax, making them relevant for both seasoned investors and novices.

What is a Stocks and Shares ISA?

A Stocks and Shares ISA is a type of individual savings account where you can hold various investments, including stocks, bonds, mutual funds, and other eligible assets. Unlike a Cash ISA, where you earn interest on deposits, the Stocks and Shares ISA allows for potential higher returns through capital growth and dividends, albeit at a higher risk due to the nature of the stock market.

Key Benefits

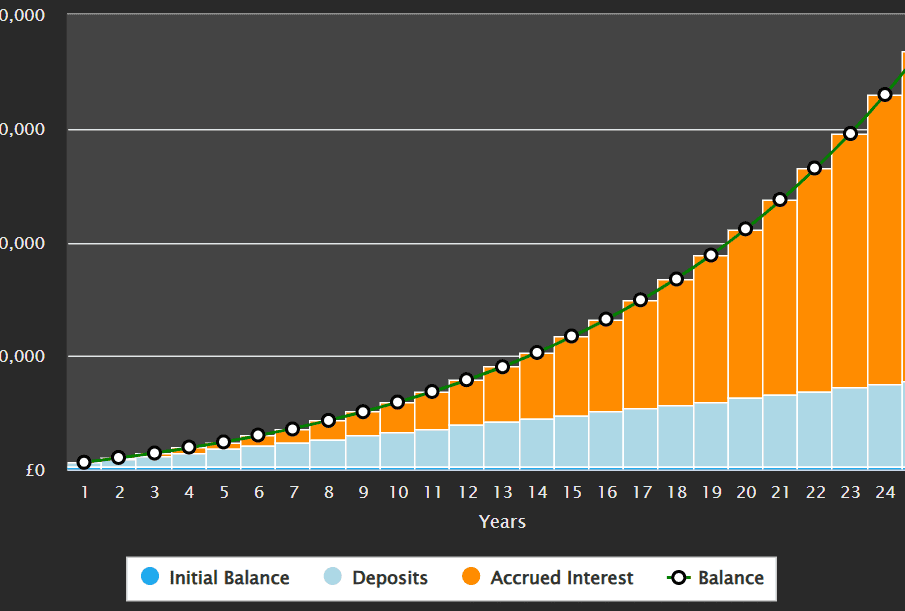

One of the main advantages of a Stocks and Shares ISA is that any returns you make from your investments are free from Income Tax and Capital Gains Tax, up to your annual allowance. For the tax year 2023/24, the maximum contribution limit is £20,000 per individual. This means that your investments can grow without the hindrance of tax deductions, substantially enhancing your overall returns over time.

Investment Flexibility

Another appealing aspect of Stocks and Shares ISAs is the flexibility they offer. Investors can choose to manage their investments actively or take a more passive approach through ready-made portfolios and funds. Furthermore, you can switch your investments within the ISA without incurring tax penalties, making it easier to respond to market changes or personal financial situations.

Risks and Considerations

While Stocks and Shares ISAs can yield higher returns, they come with a degree of risk. The value of investments can fluctuate, and there is no guarantee of returns. It’s crucial for investors to conduct thorough research or seek financial advice, particularly in today’s volatile markets. Investors should also review their risk tolerance and investment goals before committing funds to ensure alignment with their financial strategy.

Conclusion

As interest in investment options continues to grow, Stocks and Shares ISAs remain a compelling choice for UK residents looking to build and diversify their portfolios. Success in this space requires careful planning, market research, and an understanding of personal financial goals. With the tax advantages and investment opportunities provided by a Stocks and Shares ISA, individuals can navigate their path to financial growth, while being mindful of the inherent risks associated with stock market investments.