A Comprehensive Guide to HMRC Savings Tax

Introduction

HMRC (Her Majesty’s Revenue and Customs) savings tax plays a vital role in the United Kingdom’s financial landscape. As individuals continue to save for the future, understanding how these taxes work becomes increasingly important. With the recent adjustments to tax regulations and threshold limits, it is essential for savers to be informed about the implications of HMRC’s savings tax on their earnings and potential impact on long-term savings strategies.

What is HMRC Savings Tax?

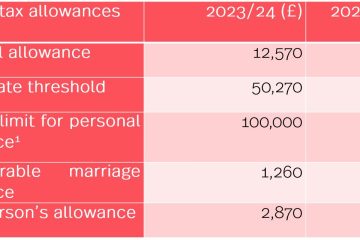

HMRC savings tax refers to the taxation on the interest earned from savings accounts, investments, and other financial instruments. In the UK, individuals are granted a tax-free allowance known as the Personal Savings Allowance (PSA), which allows basic rate taxpayers to earn up to £1,000 tax-free and higher rate taxpayers up to £500.

Recent Changes and Current Thresholds

As of the 2023 tax year, the HMRC has maintained the allowances, but the economic climate has prompted discussions on potential future changes. Factors such as rising inflation and cost of living have led individuals to consider their savings with more urgency. Financial experts have noted that individuals should keep abreast of policy changes that may affect their savings. For instance, the introduction of a reduction in interest tax-free limits or an alteration in the PSA could significantly influence how savers strategise their financial plans.

How HMRC Savings Tax Affects Savers

Understanding the implications of HMRC savings tax is crucial for effective financial planning. Taxable interest from savings can reduce overall earnings yield, prompting may to explore alternative savings vehicles that offer tax benefits, such as ISAs (Individual Savings Accounts). ISAs allow individuals to earn interest without incurring tax, thus serving as a popular choice for many UK residents looking to optimise their savings.

Conclusion

In conclusion, HMRC savings tax remains a significant consideration for anyone looking to maximise their savings in the UK. The current allowances provide some tax relief, but as economic conditions evolve, so too may the taxation framework. Savers are encouraged to stay informed about any modifications to tax laws and seek advice where necessary. Planning ahead and understanding the ramifications of tax may lead to more informed saving decisions, allowing individuals to better navigate their financial futures.