Current Trends in WH Smith Share Price

Introduction

The performance of WH Smith share price is an important indicator of the company’s health and its position in the retail sector. As a well-known British retailer, particularly in the travel and newsstand markets, WH Smith has faced several challenges and opportunities, especially as the market continues to recover from pandemic-related disruptions. Understanding the current trends and factors influencing its share price is crucial for investors and stakeholders alike.

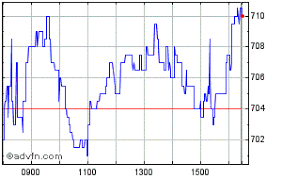

Current Market Performance

As of October 2023, WH Smith’s share price is trading at approximately £16.50, reflecting a decrease of about 5% compared to the previous month. This dip follows a strong upward trend earlier in the year, where shares peaked at near £18. The fluctuations in share price can be attributed to various factors, including changing consumer behaviour, economic conditions, and the company’s financial results.

Financial Performance

In its most recent financial report, WH Smith announced a robust revenue growth of 15% year-on-year, primarily driven by its international travel business. With the easing of travel restrictions, the company has seen an uptick in foot traffic in airports and railway stations, contributing significantly to its overall revenue. However, rising input costs and inflationary pressures have impacted profit margins, leading to cautious investor sentiment in recent weeks.

Future Outlook

Analysts remain divided on the future trajectories of WH Smith’s share price. Some experts predict a rebound, especially as travel continues to increase and the company expands its product offerings. Others caution that the retail environment is still volatile; factors such as economic uncertainty and consumer spending patterns could heavily influence the share price in the coming months. Additionally, WH Smith’s strategic investments in digital platforms and convenience stores may play a crucial role in enhancing its overall market position.

Conclusion

In summary, WH Smith’s share price remains a focal point for many investors as it reflects broader retail trends and the recovery of travel. With a mixture of caution and optimism pervading the market, it is essential for investors to stay informed about the company’s financial health and external market conditions. As the company navigates through this transitional phase, stakeholders should closely watch the factors influencing both consumer behaviour and overall economic performance as they could have lasting implications on share values.