Understanding NASDAQ: Current Trends and Events

The Importance of NASDAQ

NASDAQ stands as one of the most significant stock exchanges globally, renowned for its high-tech listings and electronic trading system. Established in 1971, it has continually evolved, reflecting the changing landscape of global finance. Its relevance today is underscored by the crucial role it plays in the technology sector, housing some of the most influential companies in the world, including Apple, Amazon, and Microsoft. Understanding NASDAQ is essential for investors, analysts, and anyone interested in the dynamics of modern finance.

Recent Developments on NASDAQ

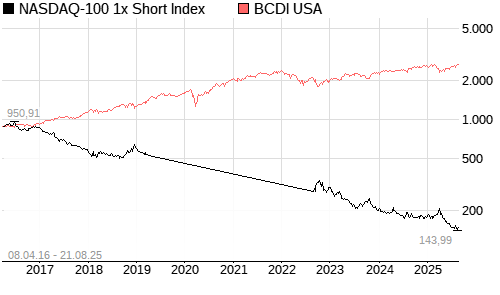

As of October 2023, NASDAQ has witnessed a volatile trading environment influenced by various factors, including inflation concerns, interest rate hikes, and geopolitical tensions. The index has made headlines recently due to fluctuating performance attributed to mixed earnings reports from major tech companies. For instance, while some tech giants reported better-than-expected earnings, others fell short, leading to an overall mixed sentiment in the market.

Investor sentiment has been further complicated by the Federal Reserve’s indication of potentially continuing its rate hiking cycle, a move which could dampen technology stocks that typically rely on lower interest rates for growth. As tech companies have dominated NASDAQ’s market cap, such monetary policies reverberate throughout the index.

Market Trends and Predictions

Analysts predict that the upcoming months will be crucial for NASDAQ as companies release their third-quarter earnings reports. Investors are particularly watching for insights into consumer spending trends and supply chain issues that have plagued many industries. Increased competition in the tech sector, especially from emerging companies, adds another layer of complexity for established firms on the NASDAQ.

Moreover, environmental, social, and governance (ESG) factors are becoming increasingly significant in investment decisions, prompting NASDAQ-listed companies to adopt more sustainable practices. This trend could potentially attract a new wave of investment aimed at socially responsible investing.

Conclusion: The Significance of Monitoring NASDAQ

Navigating the NASDAQ requires a keen understanding of its ongoing developments and broader economic indicators. As we look ahead, the performance of this exchange will be closely tied to both macroeconomic factors and the internal dynamics of its listed companies. For investors, staying informed about these shifts could yield profitable opportunities, while also enabling a deeper understanding of the financial landscape ahead. In light of the rapid changes occurring in tech and investing, NASDAQ will continue to be a critical barometer of market health and investor sentiment.