Understanding the FTSE 100 Index and Its Current Trends

Introduction

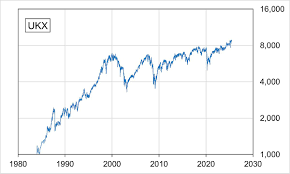

The FTSE 100 Index, often referred to simply as the ‘Footsie,’ is a crucial barometer of the UK stock market, showcasing the performance of the 100 largest companies listed on the London Stock Exchange (LSE). Established in January 1984, this index is integral for investors, analysts, and policymakers as it reflects the overall health of the UK economy. Given the fluctuating nature of global markets and recent economic challenges, understanding the FTSE 100’s performance has become increasingly relevant.

Current Performance and Trends

As of October 2023, the FTSE 100 Index has experienced considerable volatility, influenced by factors such as inflation rates, interest rate hikes, and geopolitical tensions. Trends indicate a gradual recovery following the economic impacts of the COVID-19 pandemic, with certain industries, particularly energy and financial services, showing robust growth.

Recent data indicates that the index is hovering around the 7,500-point mark, reflecting a diverse trajectory for its constituent companies. For instance, firms like BP and Shell have benefitted from rising oil prices, while others in the technology sector face headwinds amid increasing economic uncertainties. According to investment analysts, this mixed performance emphasizes the importance of sector diversification when considering investments within the FTSE 100.

Recent Notable Changes

Several developments have marked the landscape of the FTSE 100 recently. In 2023, a notable shift involved the inclusion of more renewable energy companies in the index, signalling a broader move towards sustainable investment strategies. Additionally, UK Chancellor Jeremy Hunt’s budget announcements aimed at stimulating growth have also influenced investor sentiments, further impacting the index’s performance.

Conclusion

In conclusion, the FTSE 100 Index continues to be a critical indicator of market sentiment and economic conditions in the UK. As investors navigate through fluctuating performance driven by both internal and external factors, understanding the index’s movements will be essential for making informed decisions. Looking ahead, analysts predict that the FTSE 100 will remain sensitive to global economic changes, particularly with anticipated interest rate adjustments by the Bank of England. Therefore, being informed about the FTSE 100 will not only benefit investors but is vital for anyone interested in the broader economic landscape of the UK.