Understanding the State Pension Age in the UK

Introduction

The state pension age is a critical concern for millions of citizens in the United Kingdom as it directly impacts retirement planning and financial security. Adjustments to the state pension age are swift and significant, influencing when individuals can expect to receive their state pension, which is a key part of retirement income for many. Recently, the topic has gained increased attention due to proposed changes and the ongoing debate surrounding the adequacy of the current retirement system.

Recent Developments

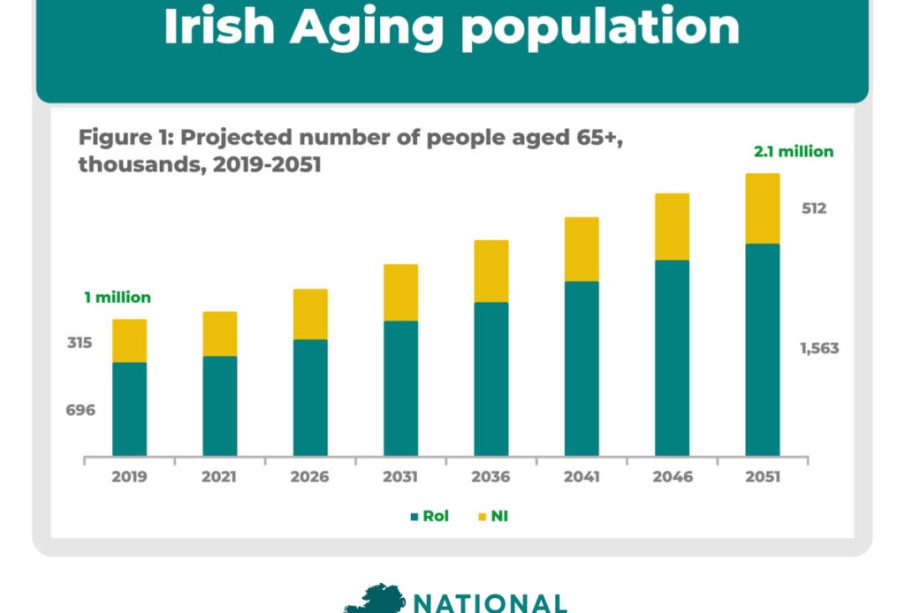

As of October 2023, the state pension age in the UK is set to rise, which means that individuals born on or after 6 April 1970 will be expecting a later retirement. Currently, the state pension age is 66, with plans to increase this to 67 between 2026 and 2028. Further changes are reportedly being considered, potentially elevating it to 68 by the late 2030s. These transitions are part of an effort by the government to ensure the sustainability of the state pension amidst an increasingly ageing population.

Public Reaction

The adjustments to the state pension age have sparked significant reaction from various sectors. While some commend the change as necessary for fiscal responsibility, others argue that the rise in the pension age unfairly burdens those in physically demanding jobs who may struggle to work longer. Campaigns calling for a re-evaluation of these proposed changes highlight concerns about the increased pressure on low-income workers and the impact on mental and physical health as employees face prolonged work periods.

Financial Planning Implications

For many individuals approaching retirement, understanding the state pension age is vital for effective financial planning. Delays in pension payments necessitate reassessments of savings strategies and retirement goals. Experts advise individuals to consider additional private pension contributions or investments to ensure a balanced financial portfolio that includes sufficient retirement funds. The financial sector is responding with products tailored to those affected by the changing landscape of state pensions.

Conclusion

The state pension age in the UK is set to evolve, and it’s essential for individuals to stay informed and adjust their retirement strategies accordingly. While these changes aim to promote sustainability for future generations, the implications for current workers are profound and merit awareness and action. Moving forward, public discourse and financial literacy will be critical in preparing for a secure retirement amidst an ever-shifting welfare landscape.