Recent Trends in Shell Share Price: An Analysis

Introduction

The share price of Shell, one of the world’s leading integrated energy companies, is a subject of considerable importance for investors, analysts, and market observers alike. Its performance not only reflects the company’s business health but also serves as an indicator of trends within the energy sector. With fluctuations driven by global oil prices, geopolitical factors, and investment strategies, understanding the dynamics of Shell’s share price is crucial for making informed investment decisions.

Current Trends and Analysis

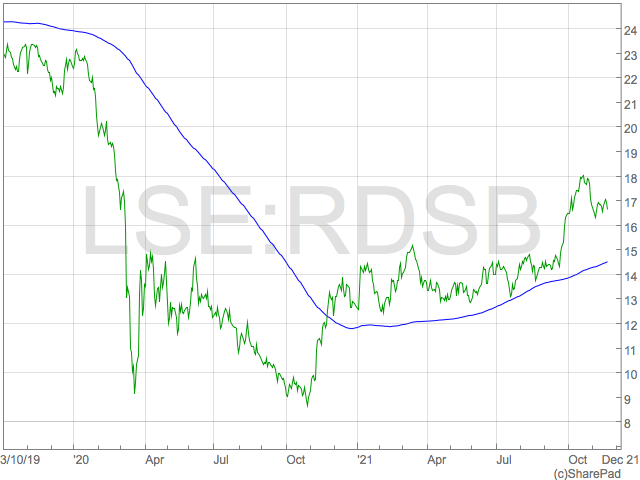

As of mid-October 2023, Shell’s share price has been experiencing notable volatility. Recent reports indicate that as of October 15, shares are trading around £22, reflecting a decline of approximately 3% over the past month. This drop comes amid fluctuating crude oil prices which recently saw a sharp increase due to supply chain disruptions and geopolitical tensions in oil-rich regions.

Analysts suggest that the decline in Shell’s stock value may be reflective of broader market sentiments and investor concerns regarding the energy transition. With international targets for reducing carbon emissions, traditional oil companies face pressures to adapt their business models. In Shell’s case, the company is investing heavily in renewable energy sources, although critics argue that its transition has been slower than necessary.

Driving Factors

Several factors influence Shell’s share price: 1. **Crude Oil Prices**: Fluctuating oil prices directly impact Shell’s profitability due to its sizable oil production capabilities. Recently, prices have been volatile, impacting market reactions. 2. **Regulatory Environment**: Changes in government policies regarding fossil fuel consumption and environmental regulations can affect investor confidence. 3. **Earnings Reports**: Like other corporations, Shell’s quarterly earnings reports provide insights into its financial health and often lead to immediate shifts in share price. 4. **Market Sentiment**: Broader economic indicators, including inflation rates and global financial trends, also play a significant role in shaping investor behaviour.

Conclusion and Future Outlook

Looking ahead, investors should keep an eye on macroeconomic indicators and shifts within the global energy landscape as these factors will continue to influence Shell’s share price. Recent efforts by Shell to increase investments in renewable energy may provide some long-term reassurance. Additionally, any changes in crude oil prices or unexpected geopolitical events could further impact shareholder value. Investors are advised to remain vigilant and consider diversifying their portfolios to mitigate risks associated with traditional energy investments.