Current Trends in Bitcoin Price: An Overview

The Importance of Bitcoin Price in Today’s Market

In recent years, Bitcoin has transformed from a niche digital currency into a mainstream financial asset, attracting both investors and speculators. Understanding the trends and fluctuations in Bitcoin price is essential not only for cryptocurrency enthusiasts but also for the global economy, as Bitcoin often acts as a bellwether for the overall market dynamics. With a growing number of institutions and retail investors now entering the space, this volatility can have widespread implications.

Recent Developments in Bitcoin Price

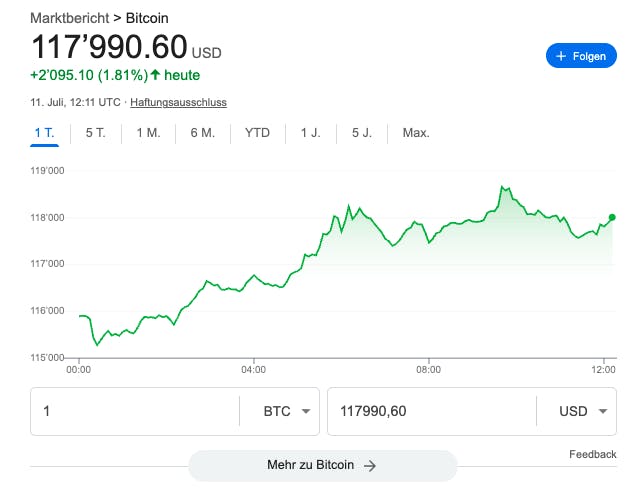

As of October 2023, the Bitcoin price has exhibited significant variability, currently sitting around £25,000, a notable increase from prices recorded earlier in the year. Analysts attribute this rise to several factors, including increasing institutional adoption, regulatory developments across various countries, and macroeconomic changes that have encouraged investment in alternative assets. Bitcoin’s recent surge followed announcements from major financial institutions that they would be integrating cryptocurrency solutions into their services.

Furthermore, according to data from CoinMarketCap, Bitcoin achieved a market capitalisation surpassing £470 billion, solidifying its status as the leading cryptocurrency by market cap. This growth has been accompanied by heightened interest in newer cryptographic technologies and products, such as Bitcoin ETFs and sector-specific blockchain applications.

Market Influences and Future Predictions

Several critical trends appear to be influencing the Bitcoin price trajectory. The ongoing debates around cryptocurrency regulation have introduced uncertainty, particularly in the United States, where clearer guidelines are still evolving. The potential for new regulations could either bolster Bitcoin’s legitimacy or create further hurdles for its adoption.

Furthermore, macroeconomic factors such as inflation and international geopolitical tensions continue to play a role in investor behaviour. Many view Bitcoin as a ‘digital gold’—a hedge against inflation—which might explain its renewed popularity amid turbulent economic conditions. Some analysts predict that if Bitcoin continues on its current trajectory, we might see prices rallying upwards of £30,000 by the end of this year, contingent on favourable market dynamics and reduced regulatory pressure.

Conclusion: The Future of Bitcoin Price

The Bitcoin price will undoubtedly remain a focal point for both cryptocurrency enthusiasts and investors alike. As the digital currency landscape continues to evolve, understanding the underlying factors driving Bitcoin’s price changes is more important than ever. As institutional interest grows and regulatory environments clarify, there could be a lasting change in Bitcoin’s market perception—positioning it either as a robust financial instrument or a speculative asset prone to volatility. For both seasoned investors and newcomers, keeping a keen eye on Bitcoin’s price movements and market trends will be crucial in navigating this complex and rapidly evolving financial landscape.