Understanding HMRC Tax Refund Letters

Introduction

HMRC tax refund letters are crucial documents that inform taxpayers in the UK about their potential eligibility for a tax rebate. As the end of the financial year approaches, many individuals await these letters, often feeling anxious or unsure about the information contained within them. Understanding how these letters work is vital, as it can significantly impact one’s financial planning and tax obligations.

What are HMRC Tax Refund Letters?

HMRC (Her Majesty’s Revenue and Customs) issues tax refund letters to inform individuals that they have overpaid tax throughout the financial year. This can occur for various reasons, such as changes in employment status, errors in tax codes, or eligibility for specific tax reliefs that the taxpayer may not have initially claimed. These letters may also include instructions on how to claim the refund and any deadlines that must be met.

Recent Developments

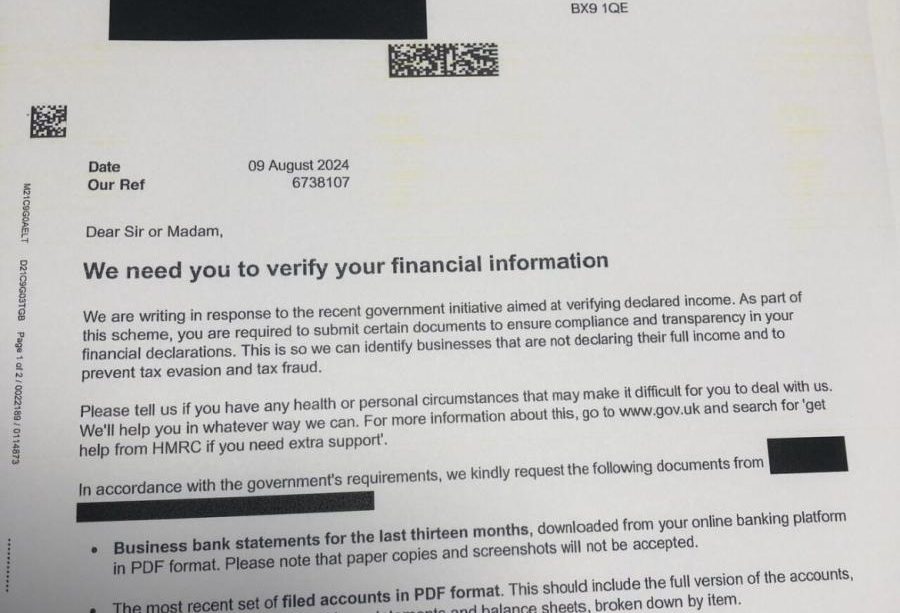

In recent months, HMRC has enhanced its communication strategies to ensure that taxpayers are fully informed about their finances. With the rise of digital correspondence, many taxpayers now receive their tax refund notifications electronically, thereby improving efficiency. However, this has raised concerns about security and the potential for scams. HMRC has emphasised the importance of verifying the source of any correspondence claiming to be from their office, reminding taxpayers to watch out for fraudulent letters and emails.

How to Handle a Tax Refund Letter

Upon receiving a tax refund letter, it is critical that taxpayers review the information carefully. This includes confirming the amount of the refund, understanding why it was issued, and following the outlined procedures to claim the refund. For those who believe they have received a letter by mistake, HMRC advises contacting them directly for clarification. It is also pertinent for individuals to keep a record of any correspondence for future reference.

Conclusion

Understanding HMRC tax refund letters is an essential part of managing personal finances effectively. As the tax landscape continues to evolve with digital advancements, staying informed about one’s tax arrangements becomes vital. Taxpayers should remain vigilant against potential scams and seek assistance when in doubt. In a time when financial awareness is paramount, knowing how to interpret and act upon these letters can lead to significant returns and peace of mind.