Exploring Monzo Bank: A Revolution in Personal Banking

Introduction

Monzo Bank, a digital-first challenger bank based in the UK, has significantly transformed the personal banking landscape since its inception in 2015. With its user-friendly mobile app and commitment to transparency, Monzo caters to a tech-savvy generation seeking seamless banking solutions. As traditional banks grapple with digitalisation, Monzo stands out, attracting millions of users and reshaping customer expectations.

Key Features and Services

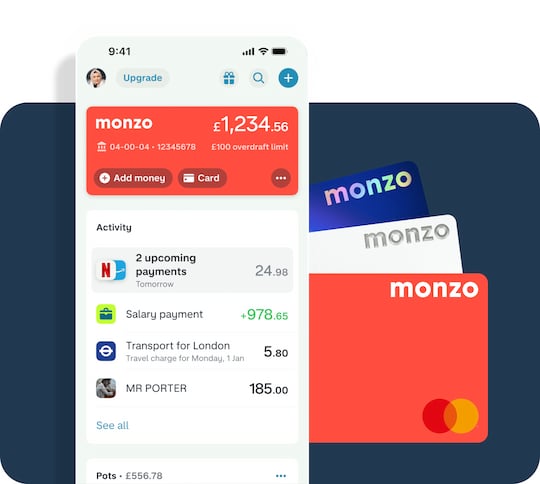

Monzo offers a plethora of features designed to enhance customer experience. The app enables users to manage their finances in real-time, track spending, set budgets, and receive instant notifications for transactions. More recently, Monzo has introduced the ability to earn interest with its savings pots, enhancing the traditional banking experience.

In addition, the bank’s no-foreign transaction fees on international purchases and fee-free ATM withdrawals abroad have made it a popular choice for travellers. Monzo’s approach prioritises a transparent fee structure, which appeals to users who are often disillusioned with hidden charges associated with conventional banking.

Current Developments

In recent months, Monzo has expanded its reach by introducing small business banking accounts, a significant move acknowledging the increasing trend of freelancers and small business owners who require tailored financial services. Furthermore, the bank is investing in new technologies to improve its fraud detection systems and enhance user security as it manages sensitive financial data.

Impact on the Banking Sector

Monzo’s rise accompanies a broader shift in consumer behaviour towards digital banking. The Covid-19 pandemic accelerated this trend, with many shifting to online services. According to a recent survey, nearly 60% of UK consumers now prefer using digital banks over traditional banks, primarily due to convenience and lower costs.

Conclusion

As Monzo Bank continues to evolve, it is likely to play an essential role in shaping the future of banking in the UK and beyond. Its focus on innovation, user experience, and transparency is compelling other banks to rethink their strategies to stay competitive. With forecasts suggesting that digital banking will continue to grow, Monzo stands at the forefront, ready to seize new opportunities and further disrupt the traditional banking sector. For consumers, this means more choices and better services in personal finance management.