Understanding State Pension Age Changes in the UK

Introduction

The state pension age is a critical topic for British citizens as it directly impacts financial planning and retirement readiness. With ongoing discussions surrounding pension reforms, understanding the current state pension age and its implications for the workforce is increasingly vital.

What is the Current State Pension Age?

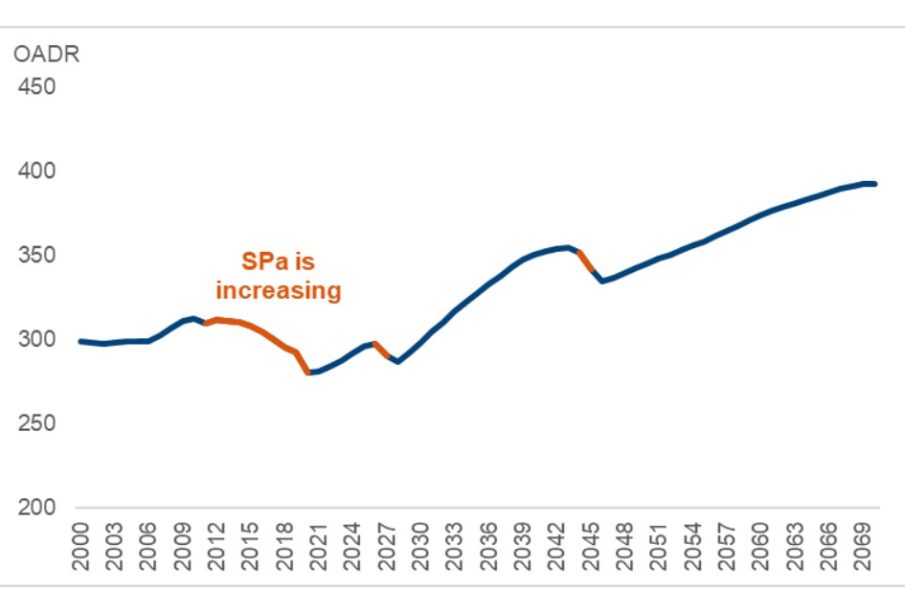

As of October 2023, the state pension age in the UK is set to rise for both men and women. Currently, both genders reach the state pension age at 66, with further increases scheduled. The government has announced plans to increase the pension age to 67 between 2026 and 2028, and potentially to 68 between 2044 and 2046. These changes are crucial for ensuring the sustainability of the pension system as life expectancy increases.

Why are Changes Happening?

The adjustments to the state pension age have sparked discussions regarding their necessity. Rising life expectancy means people are living longer, which puts more pressure on public finances to support state pensions. The ageing population in the UK, coupled with fewer workers supporting a larger retired population, has prompted the government to rethink the pension age. As a result, many citizens are now required to work longer before they can claim their state pension.

Impact on Individuals

These changes have significant implications for individuals currently in the workforce. Many workers are expressing concerns over the ability to work longer, particularly in physically demanding jobs. There is also anxiety regarding the adequacy of savings for retirement among younger generations who may have to wait longer to receive their state pension. Moreover, individuals close to retirement age are urged to reassess their financial plans to accommodate potential delays in pension payments.

Public Response and Future Forecasts

Public response to changes in the state pension age has been mixed. Some support the need for reform, recognising the financial pressures on the state system, while others call for a more gradual approach to changes, especially for those nearing retirement. Advocacy groups continue to lobby for fairness in how and when pension age increases are enacted. Future forecasts suggest an ongoing dialogue will be necessary to address the needs of an evolving workforce and demographic changes.

Conclusion

Understanding the state pension age and its anticipated changes is crucial for all current and future workers in the UK. As the government continues to review pension policies for sustainability, workers need to stay informed and adjust their retirement plans accordingly. The ongoing discussions surrounding the state pension age will likely shape financial futures for generations to come, making it an essential topic for public discourse.