Understanding State Pension Changes in 2023

Introduction

The state pension serves as a crucial financial foundation for millions of retirees in the United Kingdom. As life expectancy increases and economic conditions evolve, adjustments to the state pension system are inevitable. In 2023, significant changes have been proposed that could reshape the future for current and prospective pensioners, making it vital for individuals to stay informed.

Recent Changes to State Pension

Following a long period of debate, the UK government has announced several important changes to the state pension scheme, set to take effect in April 2023. One of the most notable alterations is the increase in the state pension age, which will gradually rise to 67 by 2028. This decision aims to ensure the sustainability of the pension system in light of an ageing population.

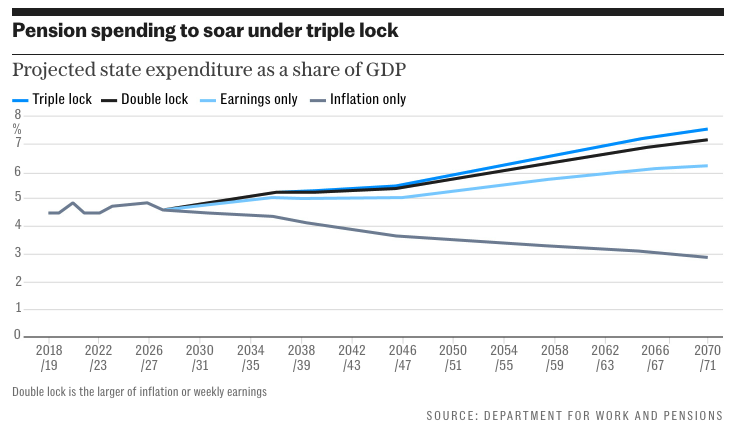

Additionally, the amount individuals receive from the state pension will see an increase in line with the ‘triple lock’ mechanism, which guarantees that pensions rise by the highest of wage growth, inflation, or 2.5%. For the 2023-2024 financial year, this adjustment is set to result in a substantial increase in payments for the pensioners, providing essential financial relief amidst rising costs of living.

Economic Impact and Considerations

These state pension changes have stirred considerable debate among economic experts and social commentators. Supporters argue that increasing the state pension age is essential for the long-term viability of the system, while critics warn it places undue pressure on older workers who may struggle to remain in employment until retirement age. Moreover, the inflation-linked rise in pensions is crucial for helping retirees cope with soaring energy prices and other living costs.

Local advocacy groups have also raised concerns about potential disparities that may arise. Many older individuals who are unable to work due to health issues could find themselves in a precarious financial position if they have to wait longer for their state pension entitlements.

Conclusion

The changes to the state pension in 2023 are set to have a significant impact on the UK’s retirees. As the government adjusts policies in response to demographic and economic pressures, it is imperative for individuals to understand how these changes will affect their financial planning. Retirees and those nearing retirement must stay vigilant and informed to navigate the shifting landscape of pensions. With predictions of further adjustments in the future, ongoing awareness will be key to ensuring financial security in later life.