Understanding the Role of the Bank of England

Introduction: The Significance of the Bank of England

The Bank of England (BoE) plays a pivotal role in the economic stability and financial health of the United Kingdom. Established in 1694, it functions as the nation’s central bank and is responsible for issuing currency, overseeing monetary policy, and maintaining financial stability. Understanding the BoE’s recent actions is crucial for grasping the current economic landscape, especially amidst inflationary pressures and post-pandemic recovery.

Recent Developments and Key Decisions

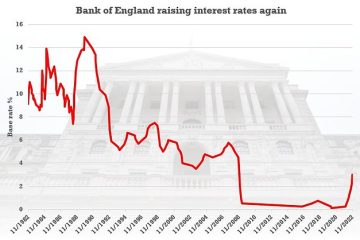

As of late 2023, the Bank of England is navigating a complex economic environment marked by rising inflation, which has surged to levels not seen in decades. In response, the BoE has implemented a series of interest rate hikes, taking the base rate to 5.25% as of September 2023. This move aims to temper inflation and stabilise the economy, but it has also raised concerns about its impact on consumers and businesses alike.

Moreover, the BoE’s recent Monetary Policy Committee (MPC) meetings highlighted the central bank’s commitment to tackle inflation, with forecasts suggesting that inflation could remain above the 2% target for some time. The BoE’s proactive stance includes unwinding its quantitative easing measures started during the COVID-19 pandemic, hinting at a gradual return to pre-pandemic monetary policies.

Financial Stability and Consumer Impact

The Bank of England’s decisions directly influence borrowing costs for consumers and businesses. With higher interest rates, mortgage payments for homeowners are expected to increase, which could temper housing market activity. Furthermore, businesses may face tighter financial conditions, impacting investment and hiring decisions.

Fiscal measures and fiscal policies taken by the UK government in conjunction with the BoE’s actions are critical. Analysts predict that if inflation rates do not stabilise, the BoE may face pressure to perform even more aggressive tightening than currently anticipated.

Conclusion: The Importance of Understanding the BoE

Monitoring the Bank of England’s activities is essential for anyone invested in the UK economy, from policymakers to ordinary citizens. As the institution navigates unprecedented challenges, its decisions will shape the economic landscape for years to come. Analysts recommend staying informed about further BoE announcements and economic indicators, as these will provide crucial insights into the future direction of the UK economy. The actions taken by the BoE over the next few months will be critical in addressing ongoing inflation concerns and ensuring economic recovery post-COVID-19.