An Insight into Cash ISAs: A Tax-Free Saving Option

Introduction

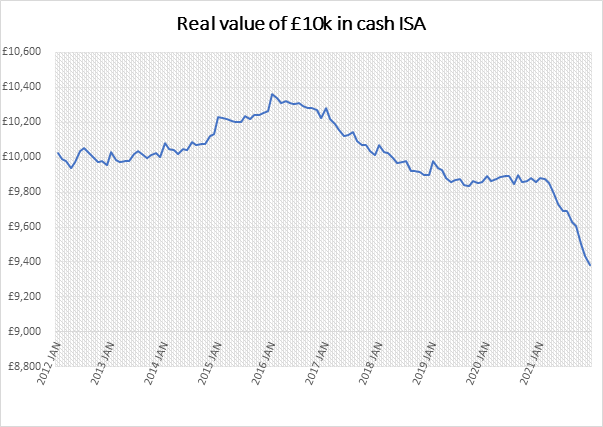

In the landscape of personal finance in the UK, Cash ISAs (Individual Savings Accounts) have gained significant traction, especially amidst the current economic climate. With rising living costs and fluctuating interest rates, understanding Cash ISAs is crucial for UK residents looking to maximise their savings while enjoying tax benefits. These savings accounts not only allow individuals to save tax-free but are also seen as a safe investment option during uncertain economic times.

What is a Cash ISA?

A Cash ISA is a type of savings account where any interest earned is tax-free, meaning that UK taxpayers do not have to pay Income Tax or Capital Gains Tax on their savings. For the tax year 2023-2024, the overall ISA allowance is £20,000, which can be spread across different types of ISAs, however, up to the full amount can be saved in a Cash ISA alone.

Current Market Trends

As of October 2023, the Bank of England has maintained a base interest rate of 5.25%, leading to competitive rates on savings accounts. Cash ISAs have become more appealing due to this, with some financial institutions offering rates over 4%. This trend suggests that consumers are taking advantage of these accounts, with new research indicating that nearly 40% of UK households have opted to use a Cash ISA for their savings. This shift is particularly noteworthy as traditional savings accounts are yielding much lower returns.

Benefits of Cash ISAs

The primary lure of Cash ISAs lies in their tax-free nature, but there are other advantages as well. For one, they are generally more flexible than fixed-term savings accounts, allowing easier access to funds. Many Cash ISAs also offer features like instant access, or the option to lock funds away for a higher interest rate. These features make Cash ISAs a versatile choice for savers who may need liquidity while still aiming to grow their wealth.

Conclusion

Cash ISAs represent an important saving tool for many, especially as the UK faces economic challenges. As interest rates continue to change, savers must remain vigilant and informed about their options. Future outlooks suggest that Cash ISAs may become even more popular as more individuals seek secure, tax-efficient methods to build their savings. For prospective savers, it is advisable to compare different providers and interest rates to optimise their savings strategy, ensuring that they make the most of their tax-free allowance.