Current Trends and Analysis of NatWest Share Price

Introduction

The share price of NatWest Group, one of the UK’s leading banking institutions, has significant implications for investors and the broader financial market. With its roots tracing back over 300 years, NatWest is a key player in the banking sector, and its share price serves as an important indicator of both the company’s performance and the health of the UK economy. As of October 2023, understanding the fluctuating share price of NatWest is crucial for investors and market analysts alike.

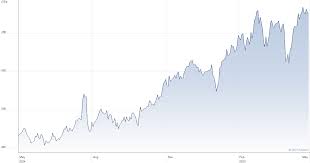

Current Share Price Trends

As of mid-October 2023, NatWest’s share price has seen considerable volatility driven by various economic factors. The company’s shares are currently trading at around £3.50, reflecting a slight increase of approximately 1.5% over the past month. This rise can be attributed to various developments including an overall recovery in the energy sector and positive signals from the Bank of England regarding interest rates.

Analysts attribute this rise to the bank’s solid financial performance, including increased lending and improved credit quality. Furthermore, the recent quarterly report revealed that NatWest posted a 10% increase in net interest income, buoyed by higher interest rates which have benefitted banks across the UK. Investors are watching closely as the bank continues to adapt to the changing economic landscape, particularly with inflation pressures influencing the market.

Recent Events Influencing Share Price

Several events have recently impacted NatWest’s share price. The UK’s ongoing economic recovery post-pandemic has seen consumer spending increase, thereby enabling financial institutions such as NatWest to benefit from an upswing in loans. However, macroeconomic challenges such as rising inflation and cost-of-living concerns remain on the horizon, potentially affecting future profit margins.

Moreover, geopolitical tensions and their effects on the global economy may continue to induce fluctuations in NatWest’s share price. The situation in Ukraine and its impact on energy prices is particularly notable, as it may create further market instability.

Conclusion

Overall, the current trends in NatWest’s share price reflect a complex interplay of positive financial results and wider economic challenges. For investors, staying informed about upcoming earnings reports and macroeconomic indicators will be crucial in making strategic decisions regarding their investments in NatWest. Looking forward, analysts forecast that the bank’s share price may remain sensitive to both domestic and international economic developments, making it an important stock to watch in the coming months.