A Comprehensive Guide to Mastercard Fees

The Importance of Understanding Mastercard Fees

In today’s digital economy, payment methods are more critical than ever. Mastercard, one of the leading credit card companies worldwide, serves millions of consumers and businesses. However, with the convenience of using credit cards comes a range of fees that can impact transactions. Understanding Mastercard fees is essential for both cardholders and business owners, as it helps in making informed financial decisions.

Types of Mastercard Fees

Mastercard fees can be broadly categorised into several types:

- Annual Fees: Some Mastercard credit cards charge an annual fee for membership, which can range from £0 to several hundred pounds depending on the card’s benefits.

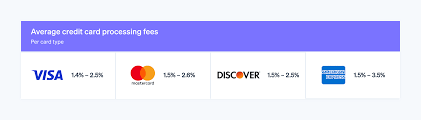

- Transaction Fees: This includes fees for cash advances and foreign transactions. Cash advances typically incur a fee of around 3-5% of the amount withdrawn, while foreign transaction fees can also be around 1-3%.

- Late Payment Fees: If a cardholder fails to make a payment on time, they might incur a late fee, which typically ranges from £12 to £35 depending on the card issuer’s policy.

- Interest Fees: For unpaid balances, cardholders will incur interest charges that can vary significantly, with APRs often ranging from 15% to 25%.

Recent Developments

In recent months, Mastercard has made headlines by announcing efforts to reduce fees for small businesses that accept card payments. This initiative comes in light of the ongoing recovery from the economic impacts of the COVID-19 pandemic, aiming to ease the financial burden on entrepreneurs. Mastercard’s commitment to supporting businesses aims to foster a more inclusive economy by making essential services more affordable.

Impact on Consumers and Businesses

Understanding these fees is crucial as they can significantly impact spending and profitability. For consumers, being aware of fees associated with their Mastercard can assist them in selecting the right card that resonates with their spending behaviour. For businesses, embracing awareness of transaction fees can inform pricing strategies and enhance customer satisfaction through transparent communication about payment options.

Conclusion

Overall, navigating Mastercard fees requires awareness and strategy. With ongoing efforts towards fee reduction and transparency, both consumers and businesses can benefit from a deeper understanding of these costs. As digital payment trends continue to evolve, staying informed will empower cardholders to leverage Mastercard effectively, thereby driving financial health and optimal purchasing experiences. Moving forward, we can expect further collaboration between payment processors to enhance the cost-effectiveness of digital transactions across the board.