Understanding UK GDP Growth: Trends and Future Outlook

Introduction

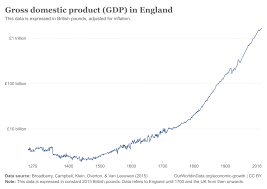

The growth of the Gross Domestic Product (GDP) in the UK is a critical indicator of the country’s economic performance and can significantly impact various sectors, from employment to investment. Recent trends in UK GDP growth have drawn considerable attention as the nation navigates the complexities of post-pandemic recovery, inflationary pressures, and potential changes in global economic dynamics.

Current Trends in UK GDP Growth

According to the latest data released by the Office for National Statistics (ONS) in August 2023, the UK’s GDP shows signs of modest growth, recording an annual growth rate of 1.5% in the second quarter of 2023. This figure slightly exceeds expectations, suggesting that the economy is on a stabilising path after the initial disruptions caused by COVID-19. The service sector, particularly hospitality and retail, has played a pivotal role in this growth, rebounding as consumer confidence improves.

However, challenges persist, including rising energy prices and inflation, which have prompted the Bank of England to implement interest rate hikes to curb price rises. Despite these measures, experts warn that these increases could potentially stifle consumer spending, thus impacting further economic growth. The Bank of England’s recent adjustments to the base rate to 5.25% are reflective of the ongoing battle against inflation, currently hovering around 6%.

Sectoral Insights

Different sectors have responded differently to the current economic climate. The services sector continues to be the backbone of the UK economy, contributing approximately 80% of the GDP. In contrast, manufacturing has seen a slowdown, as global supply chain issues and higher costs of raw materials weigh on production. Despite this, the construction sector is experiencing a resurgence, driven by government investment in infrastructure projects.

Future Outlook and Conclusions

Looking ahead, UK GDP growth is forecasted to achieve moderate growth in the upcoming quarters as the economy stabilises further. Analysts predict an annual growth rate in the range of 1.3% to 1.7% for 2024, contingent upon the government’s fiscal policies and external economic factors, including ongoing geopolitical tensions.

The significance of monitoring these economic indicators cannot be understated, as they influence corporate strategy, public policy, and individual financial decisions. For consumers and businesses alike, understanding the dynamics of GDP growth will be essential in a time of uncertainty and change.

In conclusion, while the UK shows signs of recovery, vigilance is necessary as potential inflationary pressures and external shocks may disrupt growth trajectories. Stakeholders are encouraged to keep abreast of economic indicators to make informed decisions in the evolving landscape.