Understanding the Current Landscape of Nvidia Stock

The Importance of Nvidia Stock

Nvidia Corporation, a leading technology company known for its graphics processing units (GPUs), has garnered significant attention in the financial markets, especially during the surge in demand for artificial intelligence (AI) technologies. Investors closely monitor Nvidia stock due to its pivotal role in various sectors, including gaming, cloud computing, and AI development. As of October 2023, the company continues to experience fluctuations in its stock price, driven by market trends and industry developments.

Recent Performance Trends

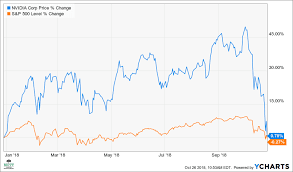

Over the past year, Nvidia’s stock has shown impressive resilience and growth. In September 2023, Nvidia shares soared to an all-time high, reaching approximately £500 per share, reflecting a remarkable increase of over 200% from the previous year. This surge is largely attributed to the company’s leadership in the AI sector, which has led to an increased adoption of its products across various industries.

However, despite this growth, Nvidia stock encountered some volatility recently. Concerns regarding the global semiconductor shortage raised questions about supply chain disruptions, impacting production rates and leading to potential delays in fulfilling customer demand. This uncertainty resulted in a temporary dip in the stock price, amplifying caution among investors.

Market Predictions and Expert Opinions

Financial analysts remain optimistic about Nvidia’s long-term prospects. According to a report from Morgan Stanley, the demand for AI-driven technologies is expected to rise exponentially over the next few years, potentially elevating Nvidia’s revenue streams. Furthermore, the company’s commitment to innovation and its strategic partnerships bolster investor confidence in the stock’s future performance.

Experts predict that Nvidia stock could see substantial gains if the company continues to deliver on its growth strategies and successfully navigates supply chain challenges. Analysts project a price target of £600 per share by the end of 2024, highlighting a favourable outlook.

Conclusion

For investors considering their options, understanding the trends and factors influencing Nvidia stock is crucial. The company’s strides in technology and substantial market opportunities in AI present a compelling case for investment. However, with market volatility and supply chain challenges at play, potential investors should stay informed and evaluate their risk tolerance before making decisions. As Nvidia continues to shape the future of technology, monitoring its stock will remain essential for those looking to capitalise on the ongoing transformation in the industry.