The Importance of Road Tax in the UK

What is Road Tax?

Road tax, officially known as Vehicle Excise Duty (VED), is a tax charged on vehicles used on public roads in the United Kingdom. This tax is crucial for the maintenance and development of road infrastructure, supporting public transport systems and ensuring safety on the roads. Understanding road tax is essential for all vehicle owners, as it directly impacts the cost of vehicle ownership and influences driving behaviours, especially in relation to emissions.

The Structure of Road Tax

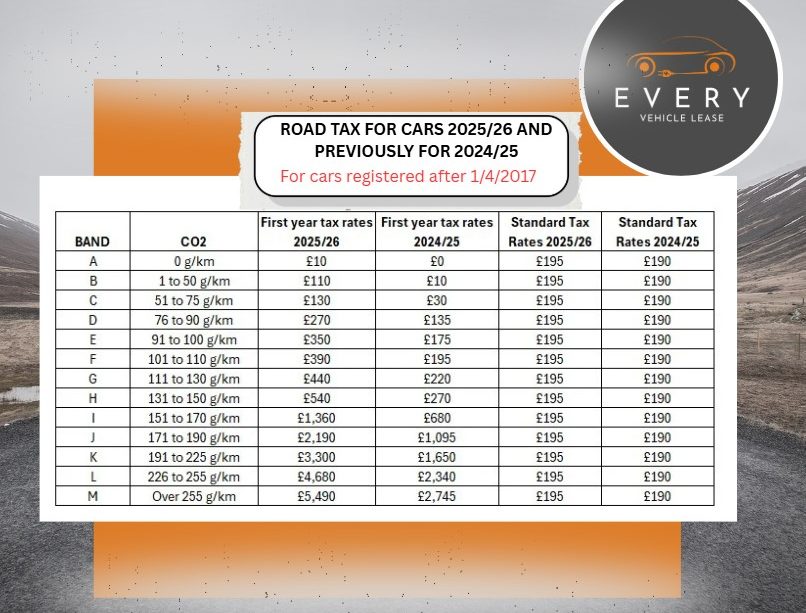

Road tax rates vary depending on several factors including the vehicle’s age, fuel type, and CO2 emissions. As of 2023, new cars are taxed according to their carbon emissions, with lower emissions attracting lower taxes. This structure encourages the use of environmentally friendly vehicles and supports the UK’s commitment to reducing air pollution. For example, electric vehicles are exempt from road tax for the first year, highlighting the government’s initiative to promote greener choices.

Recent Developments

In recent months, discussions regarding road tax have gained traction, particularly as the UK government reassesses highway funding amid increasing electric vehicle ownership. Key proposals include whether to implement a mileage-based road tax system to replace or supplement traditional VED. Such systems would ensure that all vehicle users, including electric vehicle owners who currently pay no road tax, contribute fairly to road maintenance costs. Additionally, Parliament has been considering adjustments to existing tax brackets to reflect the growing diversity in vehicle emissions.

How Road Tax Affects Drivers

For drivers, understanding road tax is crucial not only for compliance but also for financial planning. Vehicle owners are reminded to keep track of their vehicle tax renewal dates, as failing to pay could result in penalties and fines. Recent statistics reveal that non-compliance rates have increased, sparking calls for better public awareness campaigns about the importance and implications of road tax.

Conclusion

Road tax remains a vital component of the UK’s transport and environmental policies. It not only helps fund the country’s road infrastructure but also incentivises more sustainable driving practices. As discussions evolve around more modern and equitable taxation systems, it will be crucial for drivers and policymakers alike to remain informed on legislative changes and their potential impacts. Ensuring fair contributions from all types of vehicles will be key to maintaining safe, efficient, and environmentally friendly roads in the UK.