Understanding the Current FTSE 100 Share Price Trends

Introduction

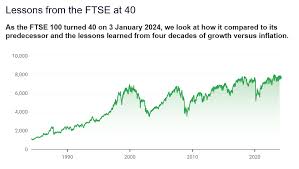

The FTSE 100 share price serves as a critical indicator of the performance of the largest companies listed on the London Stock Exchange. Comprising 100 of the most capitalised UK companies, the index reflects the economic health and market sentiment in the UK. Investors, economists, and analysts closely monitor fluctuations in the FTSE 100 as it can impact investment strategies and economic forecasts.

Recent Developments

As of the latest reports on October 24, 2023, the FTSE 100 has shown considerable movement, recently closing at approximately 7,515 points. This represents an increase of around 2.3% since the beginning of the month. Factors contributing to this rise include strong corporate earnings reports, an increase in consumer confidence, and a stable economic outlook post-pandemic.

Major companies driving this performance include energy giants and tech firms, which have benefited from rising commodity prices and increased digital service demands. Additionally, analysts noted that investor sentiment has improved as inflation rates have stabilised, and the Bank of England indicated a cautious approach towards interest rate hikes. This environment has encouraged both domestic and foreign investments in the UK market.

Market Influences

The FTSE 100 is influenced by various factors including geopolitical events, market sentiment, and economic data releases. For example, recent trends in global oil prices have positively affected energy stocks within the index. Furthermore, upcoming financial reports from key constituents of the FTSE 100 are expected to provide additional momentum to the index. Investors are particularly focused on forecasts for fourth-quarter performance and how these companies plan to navigate potential challenges, such as supply chain disruptions and fluctuating consumer demands.

Conclusion

In summary, the FTSE 100 share price is not only a barometer of UK market sentiment but also a reflection of the broader global economic environment. Given the current upward trend and strong corporate earnings, many analysts are cautiously optimistic about the potential for further growth. However, uncertainties remain, including geopolitical tensions and inflationary pressures. As such, investors should remain vigilant and consider these factors when making investment decisions. The FTSE 100 will continue to be a crucial metric for gauging economic recovery and growth prospects in the coming months.