Understanding Current UK Interest Rates and Their Impact

The Importance of UK Interest Rates

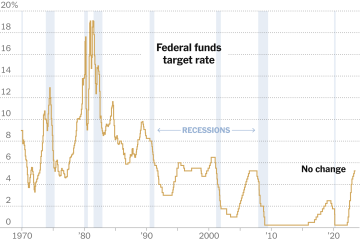

Interest rates are a critical component of the UK economy, affecting everything from borrowing costs and savings returns to consumer spending and investment decisions. Recently, the Bank of England has taken significant measures to adjust interest rates in response to fluctuating inflation and economic growth, making it essential for consumers and businesses to understand the implications of these changes.

Current State of UK Interest Rates

As of October 2023, the Bank of England’s base interest rate stands at 5.25%. This rate marks an increase from the previous year, primarily driven by the need to combat persistent inflation, which has hovered around 6.5%, exceeding the Bank’s target of 2%. The decision to raise interest rates aims to moderate consumer spending and borrowing, thus helping to stabilise prices.

Events and Influences on Interest Rates

The UK has experienced a series of economic shocks over the past year, including energy price surges, supply chain disruptions, and global economic uncertainties stemming from geopolitical tensions. The Bank’s monetary policy committee meets regularly to assess the economic situation and make adjustments as necessary. In recent months, unexpected inflationary pressures have prompted quicker responses from the Bank, illustrating the delicate balance it must maintain between fostering growth and controlling inflation.

Implications for Consumers and Businesses

The increase in interest rates has a direct impact on consumers, as borrowing becomes more expensive. Mortgage rates have risen significantly, with lenders increasing their offerings in line with the Bank of England’s rate hikes. This has created challenges for many homebuyers and those looking to refinance their mortgages. On the other hand, savers may benefit from higher interest rates on savings accounts, encouraging more robust savings habits.

Future Outlook

Looking ahead, analysts predict that interest rates might continue to fluctuate in the coming months as the Bank of England carefully navigates the economic landscape. Key indicators such as consumer confidence, inflation trends, and global economic performance will inform future policy decisions. Stakeholders should remain vigilant and adaptable to these changes to manage their financial decisions effectively.

Conclusion

In conclusion, the current state of UK interest rates reflects the complex interplay of various economic factors. Understanding these rates is crucial for consumers and businesses alike. With potential further adjustments on the horizon, staying informed will help individuals make better financial choices amidst an evolving economic climate.