All You Need to Know About FTSE Futures

Introduction

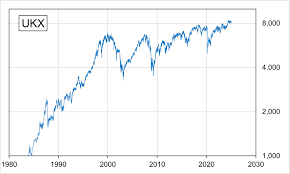

FTSE futures are an essential component of the financial landscape in the UK, providing investors with opportunities for hedging and speculation. As a derivative that reflects the expected performance of the Financial Times Stock Exchange 100 Index (FTSE 100), these futures contracts allow traders to engage with the stock market without having to purchase individual shares. Understanding FTSE futures is crucial for both seasoned investors and newcomers, especially in the context of current market volatility.

Current Market Trends

Recently, FTSE futures have been attracting significant attention due to fluctuations in global markets, influenced by economic indicators such as inflation rates, interest rates, and geopolitical events. For instance, the ongoing situation regarding energy prices and supply chain issues has been pivotal in determining market sentiment. According to recent data, FTSE 100 futures saw a rise of 1.2% earlier this week, signalling optimism among traders following positive earnings reports from major UK companies.

Additionally, the Bank of England’s recent decisions on interest rates have affected market trends, prompting discussions among financial analysts about the potential impact on the FTSE futures market. As the Bank continues to navigate inflationary pressures, traders are closely monitoring how policy changes will affect securities tied to FTSE futures.

Impact of Economic Indicators

Economic indicators play a pivotal role in the pricing of FTSE futures. Recent data released by the Office for National Statistics showed a stronger than expected rise in UK GDP, which contributed to the gains in FTSE futures. As investors digest this data, futures contracts provide a valuable mechanism for managing risks and making predictions about future market movements.

Benefits and Risks of Trading FTSE Futures

Trading FTSE futures comes with its own set of benefits and risks. On one hand, these contracts offer traders the ability to leverage their investments, meaning they can control larger amounts of stock with a smaller amount of capital. This leverage can enhance returns; however, it also increases potential losses. On the other hand, FTSE futures allow for hedging against adverse market movements, making them a popular choice for many investment strategies.

Conclusion

As the UK stock market continues to face challenges and opportunities, understanding FTSE futures becomes increasingly significant. With the backdrop of a fluctuating economy and global market uncertainties, staying informed about the dynamics of FTSE futures could prove vital for investors looking to navigate the complexities of modern trading. The coming months may reveal further insights as traders adjust their strategies in response to evolving economic conditions and market trends.