Understanding the Current Trends in GBP/USD Exchange Rate

Introduction

The GBP/USD exchange rate has significant implications for both investors and businesses engaged in international trade. As the British pound faces fluctuations against the US dollar, understanding these trends is crucial for anyone involved in currency trading, import/export, or even investing in international stocks. Recent economic data, interest rate changes, and geopolitical tensions have all contributed to the volatility of this currency pair.

Current Trends

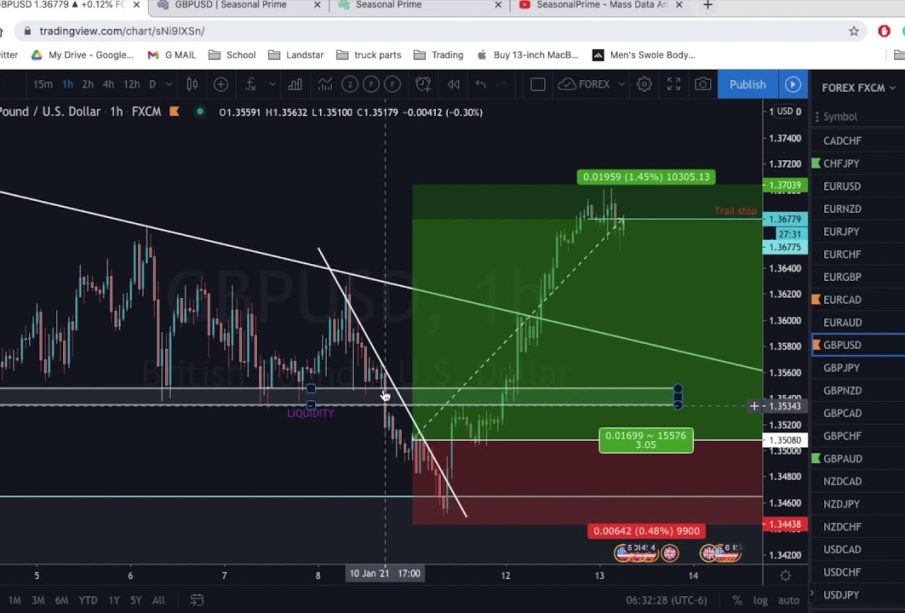

As of October 2023, the GBP/USD exchange rate has shown a series of fluctuations, currently hovering around the 1.32 mark. This represents a notable change compared to earlier this year, where the pair fluctuated between 1.25 and 1.30 in response to changing economic conditions in the UK and the US.

The Bank of England’s recent policy changes, including its decision to hold interest rates steady at 5.25%, have also played a crucial role in the currency’s performance. Meanwhile, the US Federal Reserve is expected to maintain a cautious stance, focusing on inflation management. This juxtaposition of monetary policies has resulted in the brief strengthening of the pound against the dollar.

Factors Influencing GBP/USD

Several factors influence the GBP/USD exchange rate:

- Economic Indicators: Economic data releases such as GDP growth, employment figures, and inflation reports impact market sentiment regarding both currencies.

- Geopolitical Issues: Political events, including the UK’s post-Brexit trade negotiations and US economic policies under the Biden administration, significantly sway the investment landscape.

- Market Sentiment: Investor behaviour and market speculation continue to contribute to exchanges’ volatility, with traders closely monitoring any changes in governmental stance or financial forecasts.

Conclusion

The GBP/USD exchange rate remains an essential barometer of economic health for both the UK and the US. As we approach the end of 2023, potential changes in central bank policies could further influence this currency pair. Investors should keep a close eye on economic indicators, central bank announcements, and geopolitical developments to make informed decisions. Understanding the intricacies of the GBP/USD will allow stakeholders to navigate this complex financial landscape more effectively, ensuring they remain well-prepared for any shifts that may occur.