Current Trends in Tesco Share Price: A 2023 Overview

Introduction

The share price of Tesco, one of the UK’s leading retailers, is of significant interest to investors and market analysts alike. As a barometer of consumer spending and economic health, fluctuations in Tesco’s share price can signal broader trends within the retail sector. Understanding these dynamics is crucial for stakeholders who wish to navigate investments wisely in a volatile economic climate.

Recent Performance

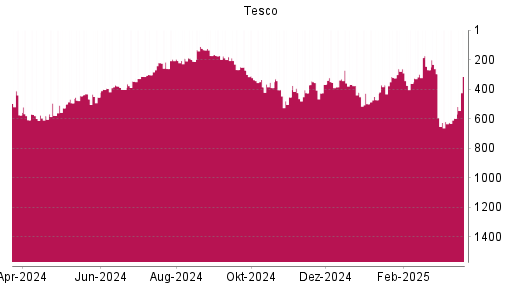

As of October 2023, Tesco’s share price has shown resilience despite the challenges posed by inflation and rising operational costs. The share has hovered around £2.60, reflecting a marginal increase of 3% from its previous quarter. According to analysts, this performance can be attributed to Tesco’s strategic investments in online grocery services and cost-cutting measures that have effectively improved profit margins.

Factors Influencing Share Price

Several key factors have influenced Tesco’s share price in recent months, including:

- Inflationary Pressures: Rising food prices have impacted consumer purchasing behaviour, yet Tesco has managed to sustain sales volume through aggressive pricing strategies and discount offers.

- Online Sales Growth: The continued shift toward online shopping has benefitted Tesco, with online sales reported to have doubled over the past year. This trend has sustained Tesco’s competitive edge against other grocery retailers.

- Expansion Plans: Tesco has announced plans to open new stores in underserved regions, which is perceived positively by investors as a move to capture market share.

Market Sentiment

Investor sentiment surrounding Tesco remains cautiously optimistic. Recent earnings reports have indicated steady growth in key performance indicators, which has encouraged analysts to maintain a ‘buy’ rating on Tesco shares. According to data from financial analysts at Bloomberg, the consensus price target is set to increase by approximately 10% over the next twelve months.

Conclusion

For investors and analysts tracking the retail market, Tesco’s share price offers insights into the broader economic climate in the UK. As the company continues to adapt to changing consumer preferences and harness opportunities in the online space, it is likely to maintain a stable growth trajectory. With projections indicating a positive outlook for the next quarter, stakeholders are advised to keep a watchful eye on Tesco, as its stock could be a valuable addition to diversified investment portfolios.