Understanding the Dynamics of Palantir Stock

Introduction

Palantir Technologies Inc., a leading data analytics company, has seen significant fluctuations in its stock price since going public in September 2020. The performance of Palantir stock is closely watched by investors given its unique role in the tech sector and its contracts with government and private entities. Understanding the movements of Palantir stock is critical for potential investors and those looking to grasp the larger shifts in the technology market.

Current Stock Performance

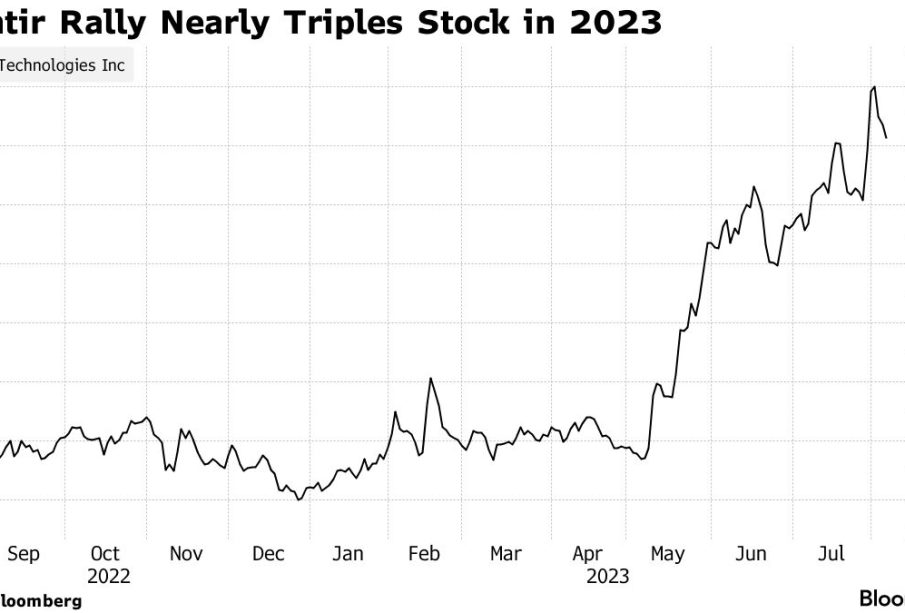

As of October 2023, Palantir’s stock trades around £15 per share, representing a growth of approximately 70% since the start of the year. The company’s strong quarterly earnings report released last month indicated increased revenue, amounting to £528 million, surpassing analysts’ expectations. This followed a period where Palantir had to address profitability concerns, marking a critical turnaround for investor sentiment.

Market Factors Influencing Palantir Stock

Several factors are currently influencing Palantir’s stock performance. Firstly, the growing market demand for data analytics solutions, especially in sectors like defence, healthcare, and finance, has placed the company in a robust position. Additionally, the firm’s recent partnerships with major corporations and government contracts have bolstered confidence among investors.

Further, macroeconomic factors, such as interest rates and inflation concerns, continue to impact technology stocks broadly. Investors are keenly observing how these factors interplay with Palantir’s business strategy. Notably, the firm’s commitment to investing in research and development suggests a sustained focus on innovation, which analysts believe will maintain its competitive advantage.

Conclusion

In conclusion, Palantir stock represents a compelling opportunity amidst the evolving technology landscape. With its strong earnings report, promising market demand, and strategic partnerships, investors are optimistic about its future trajectory. Nevertheless, external factors such as economic conditions and competition in the analytics space require careful consideration. By staying informed about these dynamics, potential investors can make more informed decisions regarding Palantir stock. Looking ahead, analysts predict that continued investment in technology and data analytics will further solidify Palantir’s position in the market, offering potential for growth for shareholders.