Understanding Google Stock: Performance and Future Trends

Introduction: The Significance of Google Stock

Google, a subsidiary of Alphabet Inc., is one of the most influential tech companies globally, driving innovation in various sectors including advertising, cloud computing, and artificial intelligence. The performance of Google stock is closely tied to broader market trends and provides valuable insights into the tech industry’s dynamics. Investors and analysts continually monitor its stock to gauge the company’s financial health and potential for growth, making it a crucial topic for understanding market shifts.

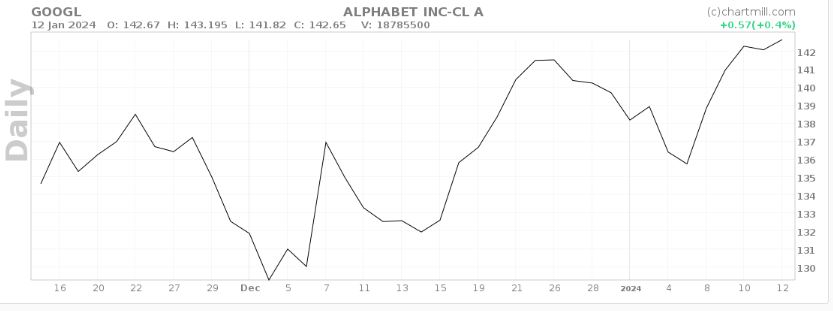

Recent Performance of Google Stock

As of October 2023, Google stock (NASDAQ: GOOGL) has shown considerable resilience despite ongoing market volatility. The stock price recently reached approximately $145 per share, reflecting a 15% increase from the beginning of the year. Analysts attribute this growth to the company’s robust earnings reports and strong advertising revenue, which constituted over 80% of their $75 billion revenue last quarter.

Moreover, Google’s continued investment in machine learning and artificial intelligence, including the rollout of the Gemini AI model, has bolstered investor confidence. This strategic direction not only enhances existing services but is also expected to create new revenue streams, further positively influencing stock performance.

Market Analysis: Factors Influencing Google Stock

Several external factors contribute to the dynamics of Google stock. One significant factor is the broader tech market climate. While tech stocks as a whole experienced dips earlier this year due to concerns over interest rates and inflation, Google’s stable business model and diversified income sources have allowed it to weather these challenges better than many of its peers.

Additionally, regulatory scrutiny remains a concern for tech giants like Google. The recent antitrust investigations in the European Union may result in operational adjustments and potential fines, which have led some analysts to adopt a cautious approach to future projections.

Conclusion: Future Outlook for Google Stock

Looking ahead, the consensus among analysts suggests a positive outlook for Google stock, with many forecasting a target price of around $160 per share by mid-2024. The company’s commitment to innovation and its strong financial performance position it as a leader in the tech industry. For investors, keeping an eye on both economic indicators and regulatory developments will be crucial for making informed decisions regarding Google stock investments. Given its strong fundamentals and growth potential, Google remains a compelling stock option in the current market climate.