Sensex Experiences Significant Gains Amidst Market Optimism

Introduction

In recent weeks, the Indian stock market has witnessed considerable movement, with the Sensex, or the Bombay Stock Exchange Sensitive Index, continuing to capture investors’ attention. As the benchmark for market performance, the Sensex reflects the health of the Indian economy and is a vital indicator for both local and international investors. With signs of economic recovery becoming more apparent, understanding the recent trends within the Sensex is essential for those looking to navigate the current financial landscape.

Recent Trends and Developments

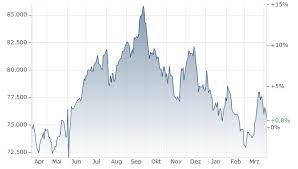

As of mid-October 2023, the Sensex has seen a substantial rise, closing at over 66,000 points, a notable increase compared to previous months. This upturn is attributed to various factors, including a resurgence in consumer spending, positive corporate earnings reports, and optimism surrounding government reforms aimed at bolstering economic growth.

Key sectors driving this growth include technology and consumer goods, which have rebounded as demand levels stabilise post-pandemic. Analysts have reported that companies such as Infosys and HDFC Bank have outperformed expectations, contributing significantly to the Sensex’s upward momentum. Moreover, foreign institutional investors, who had been hesitant in the prior months, have resumed their buying activities, further fuelling market enthusiasm.

Market Sentiments and Predictions

Despite the positive movements, market analysts are cautiously optimistic. The upcoming monetary policy review by the Reserve Bank of India (RBI) will be closely monitored, particularly regarding interest rates and inflation. The global economic landscape, influenced by geopolitical tensions and fluctuations in commodity prices, continues to pose potential risks to sustained market growth.

Experts suggest that while the current gains in the Sensex are encouraging, investors should remain vigilant and consider potential market corrections. Long-term forecasts suggest a bullish sentiment, provided that the Indian government maintains its focus on economic reforms and infrastructure development.

Conclusion

The Sensex’s recent surge signifies a promising phase for the Indian market, influenced by improving economic indicators and growing investor confidence. As India continues to recover from the pandemic’s aftermath, the Sensex will remain a key barometer of financial health and direction. Investors are advised to keep an eye on significant economic policies and global events that could impact market stability. Overall, the current optimism surrounding the Sensex invites both challenges and opportunities for stakeholders in the financial domain.