Understanding the FTSE 100: Current Trends and Insights

Introduction to the FTSE 100

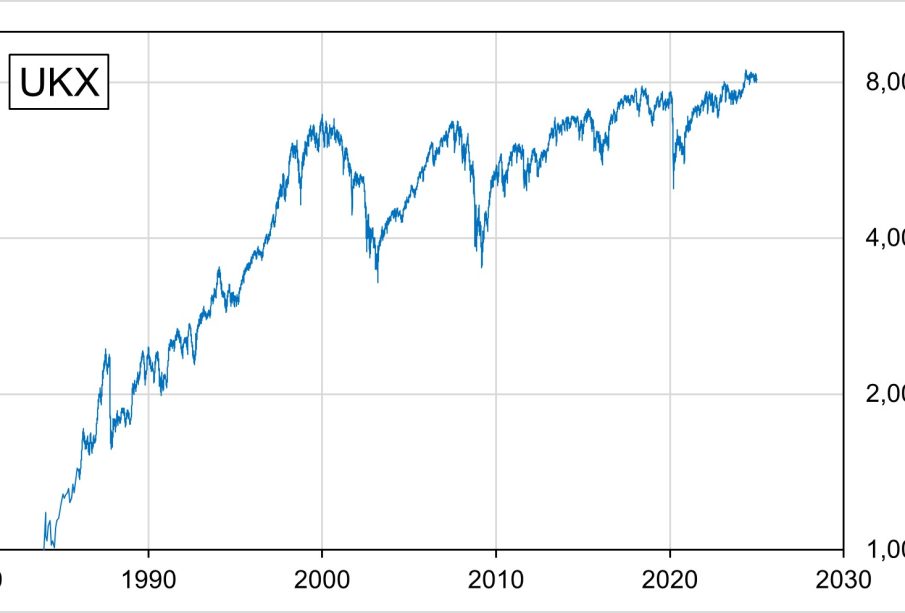

The FTSE 100 index, often referred to simply as the ‘Footsie’, is a stock market index that represents the 100 largest companies listed on the London Stock Exchange by market capitalisation. It plays a crucial role in the UK economy, serving as a barometer for economic health and investor sentiment. Understanding the dynamics of the FTSE 100 is essential for investors, analysts, and policy-makers alike, particularly in the context of current uncertainties facing global markets.

Recent Performance and Key Trends

As of October 2023, the FTSE 100 has experienced notable fluctuations influenced by various factors, including geopolitical tensions, inflationary pressures, and changes in energy prices. Recently, the index recorded a modest increase, closing at approximately 7,300 points. Despite ongoing concerns regarding the global economy, UK companies have shown resilience, with sectors such as financial services, pharmaceuticals, and commodities performing well amidst challenging conditions.

The strength of the pound against other currencies, especially the US dollar, has also impacted the FTSE 100. A stronger pound can adversely affect exports, but it may positively influence companies that import goods, leading to mixed reactions among investors. Additionally, predictions for interest rates from the Bank of England play a significant role in shaping market expectations and influencing the index’s performance.

Impact of Global Events

Global events, including the ongoing conflict in Eastern Europe and shifts in global trade policies, have exerted considerable influence on the FTSE 100. For instance, fluctuating oil prices due to the Russia-Ukraine conflict have led to volatility in energy stocks, a significant sector within the index. Major firms such as BP and Shell have been pivotal in driving the index’s performance, further highlighting the interconnected nature of global markets and the FTSE 100.

Conclusion and Outlook

Looking ahead, analysts suggest that the FTSE 100 may continue to face volatility in response to macroeconomic indicators and global events. Investors are advised to keep a close watch on trends in inflation, interest rates, and geopolitical developments. With ongoing adjustments to investment strategies and changing economic landscapes, the FTSE 100 remains a critical reference for understanding the UK’s financial health. As such, continuous monitoring of this index is vital for anyone engaged in investment and economic analysis.