Understanding the Importance of the FTSE 100 Index

Introduction

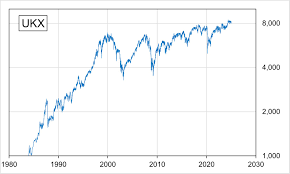

The FTSE 100 Index, often referred to as the ‘Footsie’, is a crucial indicator of the UK’s stock market performance. Representing the 100 largest companies listed on the London Stock Exchange, the FTSE 100 serves as a barometer for the health of the UK economy, attracting global investors and analysts. Its relevance extends beyond financial markets; it reflects consumer sentiment, business confidence, and the economic trajectory of the nation.

Latest Performance and Trends

As of October 2023, the FTSE 100 Index has shown a mixed performance, primarily influenced by global economic conditions, interest rates, and geopolitical tensions. Following a turbulent year in 2022, where inflation surged to unprecedented levels, the index has gradually recovered, driven by sectors such as energy and healthcare. On 20th October 2023, the index closed at 7,626.34 points, reflecting a 3% gain since the start of the year. Analysts cite a robust recovery in consumer spending and positive earnings reports from key companies like HSBC and Unilever as pivotal factors in this resurgence.

Sector Contributions

The composition of the FTSE 100 Index highlights the importance of certain sectors in driving market performance. The financial sector, including banks and investment firms, represents a significant portion of the index, making it sensitive to interest rate changes. The energy sector, given the ongoing global transitions towards renewable sources, has also seen robust activity, with companies like BP and Shell leading the charge. Furthermore, the technology sector is gradually gaining traction within the index, showcasing a shift in market behaviour as digital transformation accelerates in the post-pandemic world.

Future Outlook

Looking forward, the outlook for the FTSE 100 remains cautiously optimistic. Analysts expect continued volatility, largely due to external factors such as inflationary pressures and potential economic slowdowns globally. However, if UK domestic policies align to support growth, particularly in energy efficiency and technology advancements, the index could see sustained upward momentum. Investors should remain vigilant to market signals and global economic shifts as they navigate their investment strategies in the coming months.

Conclusion

The FTSE 100 Index not only reflects the performance of the UK’s largest companies but also serves as a critical indicator of the nation’s economic health. For investors, staying informed about the index’s movements and market trends is essential for making sound financial decisions. As the economic landscape continues to evolve, the FTSE 100 will remain a focal point for investors aiming to understand the future direction of the UK stock market.