Understanding the FTSE 100: Trends and Insights

Introduction

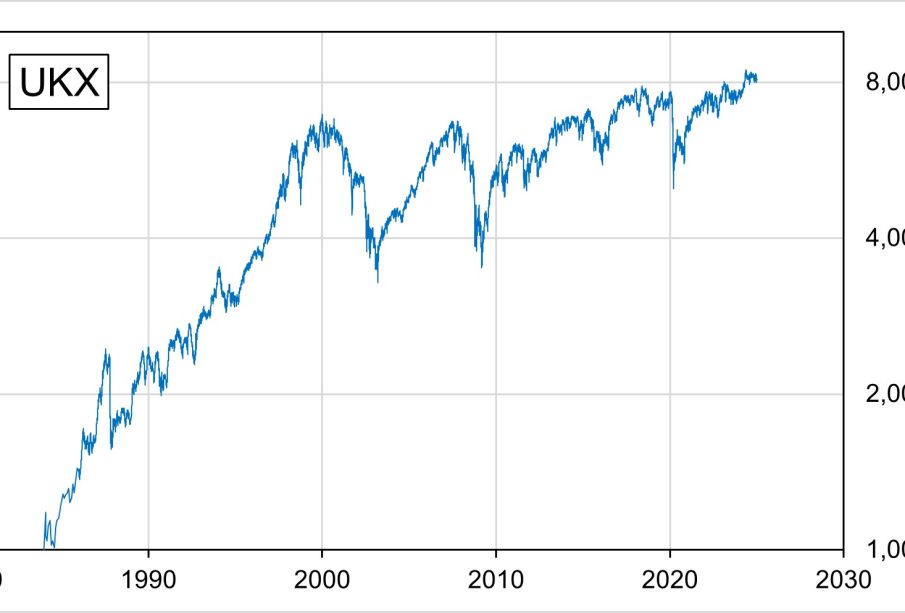

The FTSE 100 Index, often referred to as the FTSE, is a crucial benchmark of the UK stock market, representing the 100 largest companies listed on the London Stock Exchange. Understanding its performance is essential for investors, economists, and business analysts alike, as it provides insights into the health of the UK economy and reflects investor sentiment. The index is not only significant for local markets but also impacts global investment strategies.

Current Performance and Trends

As of October 2023, the FTSE 100 has been experiencing fluctuations due to various economic factors, including inflation rates, interest rate adjustments by the Bank of England, and market reactions to geopolitical events. In recent weeks, the index has shown a slight recovery after a dip attributed to rising energy prices and concerns over a potential recession. The index closed at approximately 7,500 points, reflecting both a cautious optimism among investors and ongoing uncertainties in the economic landscape.

Moreover, several sectors within the FTSE 100 have performed differently. For instance, energy and commodity stocks have benefited from the ongoing demand for resources, while technology shares have faced pressure amidst rising interest rates. Analysts predict that the performance of the FTSE 100 will remain closely tied to macroeconomic indicators, particularly those related to inflation and currency stability.

Impact of Global Events

The FTSE 100 does not exist in isolation; instead, its performance is influenced by global economic trends. The ongoing conflict in Ukraine and its implications for energy supply chains have been pivotal in shaping market conditions. Additionally, the potential for changes in US monetary policy could ripple through UK markets, affecting investor behaviour and stock valuations.

Conclusion

In summary, the FTSE 100 remains a central barometer for the UK economy and investment climate. The index’s current performance, shaped by both local and international factors, suggests a landscape of cautious engagement from investors as they navigate potential headwinds. Looking ahead, analysts anticipate that the FTSE 100 will continue to be examined closely for signs of stability or turmoil as economic indicators evolve. Investors should remain vigilant, keeping abreast of changes that could impact the index and make informed decisions based on emerging trends.