Understanding the Latest Trends in UK House Prices

The Importance of UK House Prices

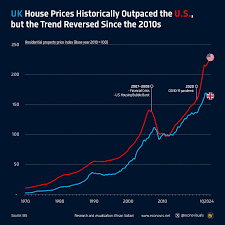

The UK housing market plays a crucial role in the nation’s economy, affecting homeowner wealth, rental markets, and the overall financial health of the country. With the significant fluctuations in house prices due to various factors, understanding the current trends is essential for potential buyers, investors, and policymakers alike.

Current Trends in UK House Prices

As of October 2023, recent data from the Nationwide Building Society indicates that UK house prices have experienced a modest decline of approximately 3% year-on-year. The average cost of a home in the UK now stands at £264,000, down from £273,000 in the previous year. This downturn is attributed to multiple factors including rising interest rates, increased cost-of-living pressures, and a slowdown in buyer activity.

In the wake of the Bank of England’s decision to increase interest rates to combat inflation, mortgage costs have also risen significantly. Homebuyers who were once comfortably within their budgets are now facing challenges in securing affordable housing, leading to decreased demand in certain segments of the market. The average mortgage rate has surged to about 6.5%, which further dampens affordability for first-time buyers.

Regional Variations

While UK house prices are generally in decline, regional variations are notable. According to recent reports, regions such as the North East and the West Midlands are experiencing less severe price reductions compared to the South East and London, where prices have sharply decreased due to an oversaturation of the market and the economic impacts of Brexit.

Future Outlook

Looking ahead, industry experts predict that the housing market may stabilise by mid-2024 as inflationary pressures ease and economic growth resumes. However, the current environment suggests that potential homebuyers should remain cautious, particularly given the uncertainty surrounding interest rates and ongoing economic factors.

Conclusion

The trends in UK house prices highlight the complex interplay of various economic forces at work. As the market adapts to new financial realities, understanding these developments is essential for anyone involved in real estate. For potential buyers, ensuring affordability remains a priority, while investors should be prepared for further fluctuations in the housing market. Overall, the significance of monitoring UK house prices continues to grow as they reflect broader economic trends and individual financial well-being.