Current Trends in Gold Price: What You Need to Know

Introduction

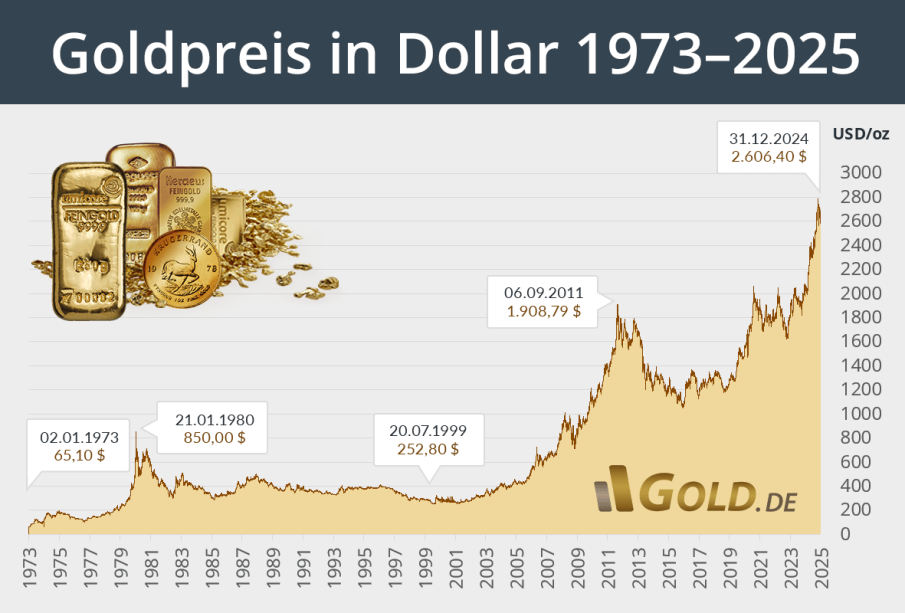

The price of gold has long been considered a crucial indicator of economic health and investor confidence. As a stable store of value, fluctuations in gold prices can signal changes in the global economy, inflation rates, and geopolitical tensions. Recently, gold prices have shown significant volatility, driven by various factors including interest rates, currency fluctuations, and market demand. Understanding these trends is essential for investors and consumers alike.

Recent Price Trends

As of early October 2023, gold prices are witnessing notable movements. On October 4, the gold price stood at approximately £1,520 per ounce, reflecting a slight increase from the previous month’s averages. This rise can be attributed to a combination of factors, including escalating inflation rates, which have prompted investors to seek safe-haven assets. Analysts point out that as central banks, especially the Bank of England, continue their battle with inflation by adjusting interest rates, the appeal of gold remains strong.

The global demand for gold has also seen a boost, particularly from emerging markets such as India and China, where cultural practices and wedding seasons typically elevate purchasing. According to the World Gold Council, demand in these regions has increased by nearly 30% compared to last year. Furthermore, the ongoing geopolitical tensions, especially in Eastern Europe and the Middle East, have led further to concerns over economic stability, enhancing gold’s attractiveness.

Market Influences

Investor sentiment plays a critical role in the pricing of gold. Recent reports indicate a growing level of uncertainty in stock markets, influenced by rising interest rates and potential recessions, which often lead investors to turn to gold for security. Furthermore, the strength of the US Dollar is inversely related to gold prices; as the dollar strengthens, gold prices usually soften. However, recent inflationary pressures have somewhat offset this trend, leading to mixed predictions from analysts regarding future price movements.

Conclusion

The current fluctuations in gold prices underscore a complex interplay of economic and geopolitical factors. For investors, understanding these dynamics is crucial for making informed decisions. As we move towards the end of 2023, experts forecast that if inflation remains high and uncertainty in various markets persists, gold prices could either stabilize or continue to rise. Keeping an eye on central bank policies and global demand will be essential for anyone involved in gold investment or purchasing. The significance of gold as a hedge against economic downturns remains unchallenged, ensuring its relevance in both financial markets and everyday life.