Current Trends in Tesla Stock Price

Introduction

The Tesla stock price has seen significant fluctuations in recent years, making it one of the most closely monitored stocks in the investment community. With the company’s reputation for innovation in electric vehicles and renewable energy, shifts in its stock price not only reflect its business performance but also broader market trends and investor sentiment. As of October 2023, the dynamics surrounding Tesla’s stock are of paramount importance to investors and market analysts alike.

Recent Developments

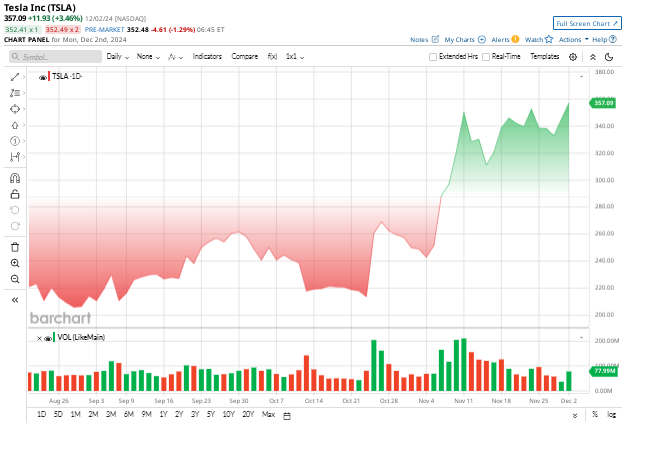

In recent months, Tesla’s stock has experienced volatility. In September 2023, the stock traded at approximately £200 per share, following a series of production updates and global market sentiments regarding electric vehicle (EV) demand. After hitting an all-time high in late 2022 at £278, current values reveal a correction phase influenced by multiple factors.

Analysts point out that production challenges in key markets, alongside supply chain issues, have contributed to a bearish sentiment. Moreover, the growing competition in the EV market from both established automakers and new entrants has increased scrutiny on Tesla’s market share. Notably, companies like Rivian and Lucid Motors have captured consumer attention, raising questions about Tesla’s future dominance in the industry.

Factors Influencing Stock Performance

Several key factors are influencing Tesla’s stock price as it navigates through this challenging landscape:

- Production and Delivery Numbers: Tesla’s ability to meet production targets and deliver vehicles is paramount. Recent quarterly reports showed a slight dip in delivery numbers, raising eyebrows among investors.

- Global Economic Conditions: The broader economic conditions, including inflation rates and interest hikes, have a direct impact on consumer spending, affecting car sales.

- Technological Innovations: Investors remain optimistic about Tesla’s commitment to innovation, particularly with its advancements in battery technology and fully autonomous driving features.

- Government Policies: Policies regarding emissions and renewable energy adoption play a significant role in investor confidence in the EV sector.

Conclusion and Forecasts

In conclusion, Tesla’s stock price reflects a complex interaction of internal and external factors. While recent corrections may deter some investors, others see value in the long-term potential of the company. Analysts remain divided on price forecasts for 2024, with estimates varying from £210 to £250 per share, depending heavily on how the company manages production challenges and competition. For investors, keeping an eye on quarterly performance and market trends will be crucial as Tesla continues to evolve in an environment rich with opportunities and challenges.