Recent Trends in the S&P 500 Index

Introduction

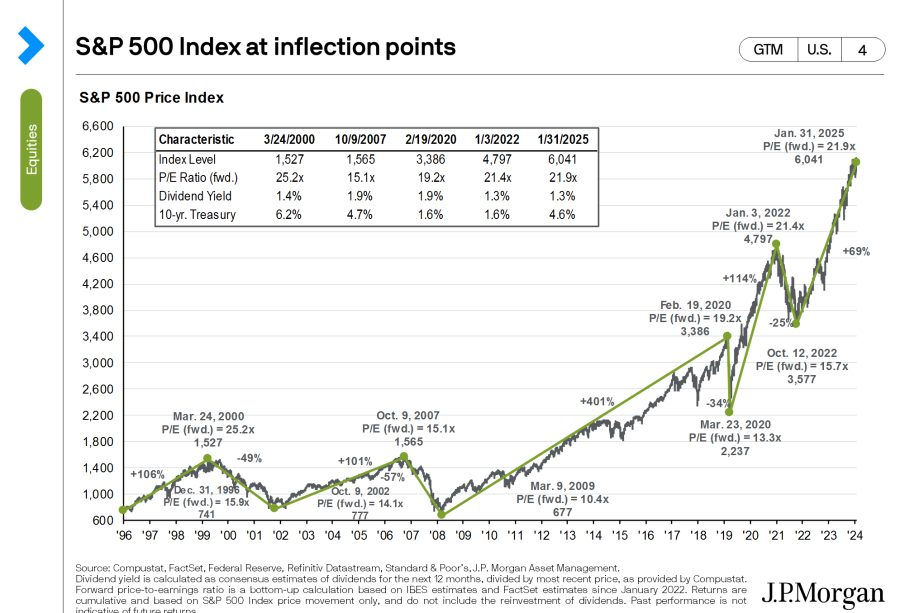

The S&P 500 index, which measures the performance of 500 of the largest publicly traded companies in the United States, plays a crucial role in understanding the health of the US economy. As a key benchmark for investors, the index provides insights into market trends, enabling informed investment decisions. Recent fluctuations in its performance highlight ongoing economic challenges and opportunities for growth.

Current Performance Trends

As of late 2023, the S&P 500 has shown a remarkable recovery from the downturn experienced earlier in the year. The index climbed approximately 18% by October, reflecting positive investor sentiment driven by stronger-than-expected earnings in the technology sector and stabilised inflation rates. Major companies, including Apple and Microsoft, have reported quarterly earnings that exceeded analysts’ expectations, contributing significantly to the index’s upward movement.

Moreover, analysts are closely monitoring the Federal Reserve’s monetary policy, particularly in relation to interest rates. Recent announcements suggest a pause in rate hikes, which is likely to provide further support for equities. This environment, coupled with positive economic indicators such as declining unemployment rates and resilient consumer spending, has added to the positive outlook for the index.

Factors Influencing the S&P 500

Several factors continue to influence the S&P 500’s performance. The ongoing geopolitical tensions, particularly in Eastern Europe and the Middle East, have created uncertainty in global markets. Additionally, concerns regarding supply chain disruptions and their impact on inflation persist. Yet, the robust performance in the technology and healthcare sectors remains a stabilising force amidst these challenges.

Conclusion

In conclusion, the S&P 500 serves as a vital indicator of market health and economic sentiment. Its recent performance reflects a complex interplay of factors including corporate earnings, monetary policy, and global events. For investors, keeping a close eye on the S&P 500 remains crucial as it not only signals market trends but also provides insights into broader economic conditions. As we approach the end of the year, analysts suggest continued volatility may occur, but the overarching forecast leans towards growth as the economy adapts to new challenges and opportunities.