Understanding the HSBC Online Banking App Outage

Introduction

On October 10, 2023, HSBC faced a significant outage with its online banking app, disrupting services for millions of customers. With an increasing reliance on digital transactions and remote banking, the reliability of online banking systems is more critical than ever. Such outages can lead to frustration and financial implications for users, making it essential to understand the causes and responses surrounding this incident.

Details of the Outage

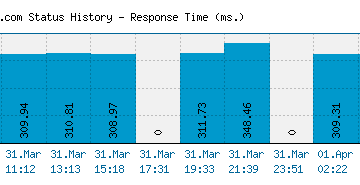

The HSBC online banking app experienced downtime beginning early in the morning, with users reporting issues accessing their accounts, making transactions, and receiving updates on their financial status. Customers took to social media platforms, expressing their dissatisfaction and seeking information as the outage continued for several hours. By mid-afternoon, reports indicated that some services were beginning to recover, although full functionality was not restored until late evening.

HSBC’s Response

In response to the backlash, HSBC issued a statement acknowledging the outage and apologising for the inconvenience caused. The bank cited a technical fault as the cause of the disruption and assured customers that they were working diligently to resolve the issue. Additionally, HSBC promised to enhance their systems to prevent future outages and improve customer communication during such incidents.

Impact on Customers

The consequences of the outage were felt across various sectors as customers were unable to access their funds for everyday transactions, including bill payments and online purchases. Many who rely solely on the app for banking faced interruptions that could not only impact their financial plans but also their trust in HSBC as a reliable banking institution.

Conclusion

The HSBC online banking app outage serves as a reminder of the vulnerabilities inherent in digital banking systems. As financial institutions continue to shift towards technology-driven services, the imperative for robust infrastructure and proactive communication strategies becomes clear. Users must stay informed about their banking options and potential setbacks while banks must prioritise system reliability and customer support to maintain trust. Anticipating the growth of online banking usage, future improvements and investments in technology will be crucial for institutions like HSBC to safeguard their operations and customer satisfaction going forward.